What is ESG Investing?

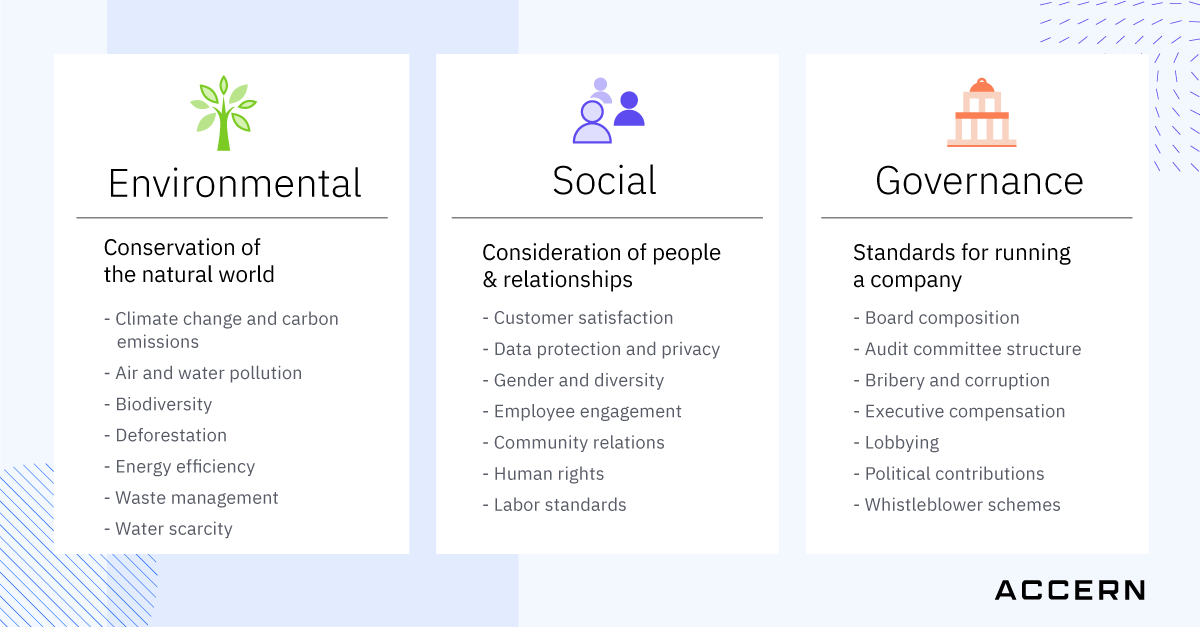

Environmental, social and governance (ESG) investing, also known as sustainable investing, is a strategy that investors use to invest their money in companies that practice habits that make the world a better place. Investors now want to reward companies that value long-term gains and social impact over near-term profit at all costs. Research has shown that companies with strong ESG mandates are less volatile and provide higher, long-term gains. What is ESG investing?

What is ESG?

The practice of socially responsible investing was first introduced in the 1960s. Investors excluded companies that practiced unethical behaviors such as tobacco production or involvement in the South African apartheid regime from their portfolios.

Ethical considerations and alignment with investor values continue as common motivations of ESG investment today, but ESG investments are rapidly growing and evolving. Many investors today place importance on incorporating ESG factors into their portfolios as much as they do on financial analysis.

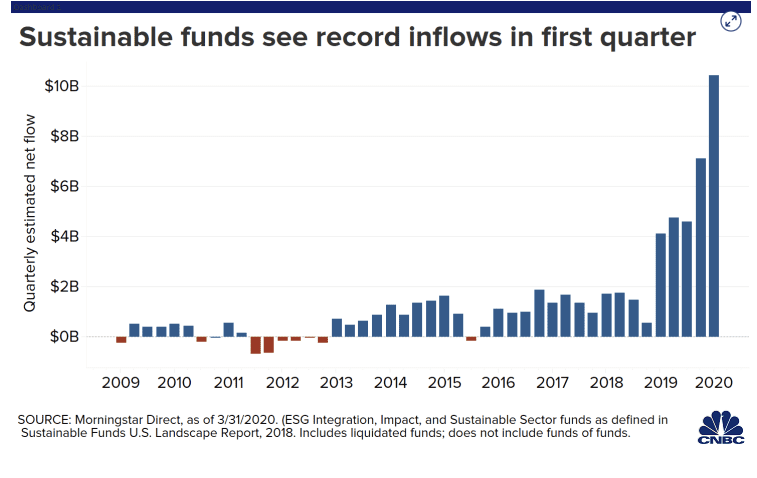

Although ESG investment isn't new, the COVID-19 pandemic has only propelled the topic and need for ESG investing by highlighting the importance of rewarding impact-driven companies that pursue sustainable goals. The recent pandemic has also shown that ESG stocks are actually more resilient during bear markets. According to a recent report by Morningstar, sustainable equity funds outperformed their peers during the initial phase of the COVID-19 pandemic last February and March. By mid-March, the returns of 66% of sustainable equity funds had ranked in the top 50 percent of their respective categories.

How younger generations are influencing ESG investing

According to report by Coldwell Banker, by 2030, Millennials will inherit over $68 trillion from their Baby Boomer parents, making them the richest generation in American history. This will represent the largest intergenerational wealth transfer in history, and companies and investors are preparing for a growth in sustainable investments as part of the investing landscape.

In a 2017 report by Morgan Stanley's Institute for Sustainable Investing, a survey showed that 86% of Millennials are interested in sustainable investing. Companies or funds that aim to generate high returns, while pursuing positive social and/or environmental impact have twice as much likelihood to attract the overall investor population. Furthermore, 90 percent of Millennials have expressed interest in a sustainable investing option within their 401(k) plans.

So why are Millennials more interested in sustainable investing than their Baby Boomer parents? Several factors impact Millennials views of sustainable goals. For one, Millennials tend to be less connected with formal institutions, including a distrust of the media, large corporations, the government, and political and religious groups. Perhaps this skepticism plays a role in their desire to hold companies accountable to their public actions, rather than assuming corporations are acting inline with morals and values. Another factor is that Millennials will have a more well-rounded education and greater exposure to financial hardships than the previous generation, with student loans, credit card debts, riding the corporate ladder, and so on.

Additionally, Millennials have experienced more social and climate issues than their Baby Boomer parents and believe they can influence positive change. Climate change, the gender pay disparity, diversity and inclusion within the workspace, carbon footprint, and supply chain issues are just a few of the issues that stand out amongst the Millennial generation. 75% of Millennials believe that their investments can influence climate change and 84% believe that their investment can help lift people out of poverty.

However, it's not just Millennials that are encouraging ESG investing. Corporate social responsibility and the belief that companies have an obligation to improve social and environmental issues is now a common theme that seems to be staying for good. According to a study by Cone Communications, 87 percent of Americans said they’d buy from a company that advocated for an issue they cared about, and 76 percent said they would boycott if they found out a company supported an issue contrary to their beliefs. Furthermore, another research report shows that 94% of the Generation Z population believe that companies should help address social and environmental issues.

How sustainable investing is shaping the future of investing

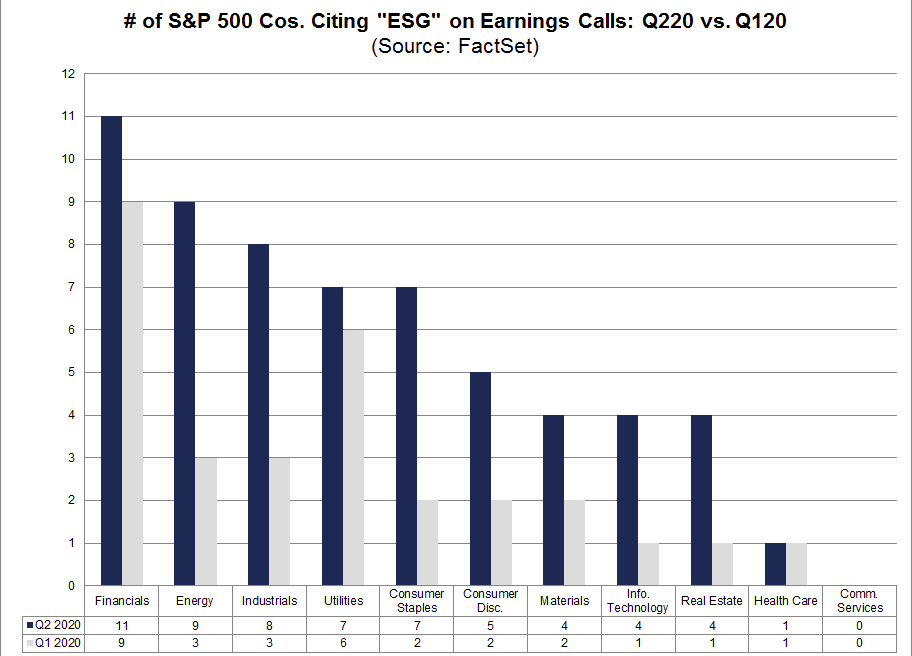

Two decades ago when the Global Reporting Initiative launched its ESG guidelines, only a handful of companies disclosed their environmental performance. Now 93% of the world's largest corporations by revenue report ESG data. In Q3 2019, FactSet reported a 29% increase in S&P 500 companies reporting "ESG" on earnings calls. From Q1 to Q2 in 2020 , FactSet reported a 100% increase in S&P 500 companies citing "ESG" on earnings calls. Companies are realizing the value of reporting ESG information, as investors and institutions are holding companies accountable with ESG criteria and scores.

Up until recent years, business leaders have held a misleading perception that one can have profits or sustainability, but not both. Historically, "environmental" products failed in the market as it provided low quality, expensive products which delivered low returns for companies. Today, this thought process has been reversed as analysis consistently shows that environmental sustainability-related operations improves resource efficiency, unlocks opportunities for process and logistics savings, and provides significantly higher financial returns. For example, a hospital report shows that reducing energy consumption and waste produced could save hospitals nearly $15 billion over a decade.

With the Global Reporting Initiative, investors are now able to track high ESG performers. Besides ESG showing a company's commitment to doing good for society, recent analysis shows that ESG investing can yield equal or higher returns than traditional investments. Furthermore, improving operations through better management of natural resources like energy and water, as well as minimizing waste can result in significant cost reductions. ESG investing can also provide stable and sometimes even higher returns and can even reduce volatility within investors' portfolios. For example, according to study done by J.P. Morgan, companies with a higher gender diversity had slightly better equity returns and lower volatility.

Some of the largest and most influential institutional investors and asset managers are leading the powerful movement towards adding ESG standards to their investment criteria. As leaders in capital, these financial institutions recognize the need to consider whether the companies they invest in today will maintain a strong relationship with customers and extended communities as environmental and social challenges increasingly impact the way we live and work. They also recognize that companies that commit to addressing social and/or environmental issues will experience greater business opportunities in the future, and will therefore achieve higher returns for long-term shareholders.

ESG funds outperform conventional funds

Morningstar's 2020 analysis, “Sustainable Funds Outperform Traditional Peers in 2020” found that 11 of 12 sustainable funds beat the S&P 500 index fund, led by IQ Candriam ESG US Equity ETF (IQSU) and Calvert US Large-Cap Core Responsible Index (CISIX), both of which are based on proprietary ESG indexes. Throughout 2020, despite the global pandemic, sustainable index funds had a positive yield.

The relatively better performance of ESG funds is tied to their focus on companies with better ESG scores and their low-carbon alignment. In 2020, sustainable funds revealed that investing with an emphasis on positive ESG criteria can produce good returns even in an uncertain economic environment.

Like any investment strategy, ESG investments will not always outperform over the short-term period. However, ESG insights can help investors construct a complete picture of a company, rather than only relying on financial statements, which can prove substantial in the long-term. ESG analysis can provide insights to early warnings on environmental or social risk before they affect a company's stock value. It can also help evaluate how sustainable a firm's long-term business model is and how well a firm treats its stakeholders.

As a growing portion of investors' portfolios are including sustainable investments, companies are influenced to turn away from short-term profits and adopt long-term perspectives that focus on creating value for all stakeholders, with better impact on society and the environment. 2020 was the year that indicated that ESG investments performed better for all stakeholders during a global pandemic.

In conclusion, ESG investing isn't just a trend brought on by Millennials. In a recent report by Allianz, 1,000 people in the U.S. over the age of 18 were surveyed. Results shows that 15% of Americans recognize the actual term "ESG," but 79% like the idea of investing in a company that takes a stance on global issues. The young generation may be influencing sustainable investment with 64% investing in ESG funds. However, even the older generation are getting on-board with 42% of Baby Boomers now investing in sustainable funds. While some investors may like the idea of rewarding companies with higher ESG scores due to the positive impact on society and the planet, many believe that ESG-mandated companies have a better chance at long-term success.

How AI can enable sustainable investments

As investors place importance on ESG scores, how companies handle diversity and inclusion, the gender pay gap, climate change, and more, ESG will soon become paramount to future investment decisions. As demand grows for sustainable investment, artificial intelligence (AI) is becoming an attractive tool to help investment firms gather useful data on companies with strong ESG practices.

Without AI, analysts may use information like investor calls or corporate social responsibility reports to track specific company practices. But with the amount of unstructured data available today and the speed at which it is generated, details that are critical to investment decisions can be missed. Information is vital, but deciphering the noise from relevant data remains a challenge.

When it comes to selecting sustainable investments, investors may track financial results, annual reports, and other statements to evaluate a corporation's ESG practices. Although many companies have great marketing strategies and mission statement, they are often not transparent about actual hiring standards, the diversity of their workforce, the behind the scenes of supply chain operations, and so on.

If an investor only relied on earnings calls, financial results, diversity and inclusion annual reports and the like, a volume of useful information would be missed, and investors could end up making uninformed decisions. AI can reveal hidden data to bring investors more insights into ESG practices. With alternative data, investment practices are taken to a new level. Analysts can monitor more companies, find hidden but useful information, and share the insights gained from the information. AI will also help analyze the data pulled by attaching a sentiment score to the content, so that investors will know what to do with the information that is found.

As AI becomes more user-friendly, it will be easier for investment firms, financial advisors and even retail investors to find and apply this information to investment decisions. Whether tracking how companies perform long-term or looking at short-term controversies, alternative data is critical in calculating ESG scores and informing ESG-driven investment decisions. ESG scores provide transparent and objective insights on a company's relative ESG commitment, performance, and effectiveness across various themes (human rights, shareholders, emissions, supply chain, sustainability, etc.) based on various data sources. Companies are scored on a scale of 0 to 100 which are divided into four quartiles.

Due to the variety and inconsistency in ESG data, how ESG is measured, and how companies report them, investors face difficulties in analyzing a company’s true ESG practices. Furthermore, there is a lack of transparency on ESG metrics by data providers, which creates inconsistencies and multiple standards of ESG reporting that don’t always line up. In addition to enhancing investors’ insights on various companies, AI enables investors to analyze structured and unstructured data and uncover valuable insights into ESG practices.

With the advancement of AI and ML tools, we were able to develop a no-code AI platform at Accern, enabling financial analysts and data scientists and engineers to use artificial intelligence without having to code. Asset management and investment firms can use our no-code AI platform to obtain custom insights into companies' ESG practices. With Accern's ready-made ESG use cases, financial teams can analyze data quickly and identify sustainable investment opportunities.

To learn more about how you can get started with ESG investing, visit Accern's ESG solutions or request to see Accern No-Code AI in action.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com