Using Artificial Intelligence to Manage Counterparty and Credit Risk

Financial lenders must understand, monitor, and manage the credit risk of their borrowers to understand the risk that potential borrowers may have on defaulting or being late on payments. Financial institutions generally address this issue by monitoring the borrower's credibility, identifying any early warning signals that show deteriorating credit, and evaluating the potential impact a given change in credit standing can have on the borrower. This blog post discusses how lenders are using artificial intelligence to manage counterparty and credit risk.

Financial firms analyze various factors to determine whether there is a risk associated with lending to a counterparty, which is the other party that participates in a financial transaction.

Counterparty risk is the probability that one of the parties involved in a financial transaction may default on its contractual obligation. Understanding, monitoring, and managing the credit risk of a financial institution's counterparties, key service providers, and business partners are important for financial firms such as banks and insurance companies as it allows them to assess financial exposure, mitigate losses, and design new business models, marketing, and pricing strategies.

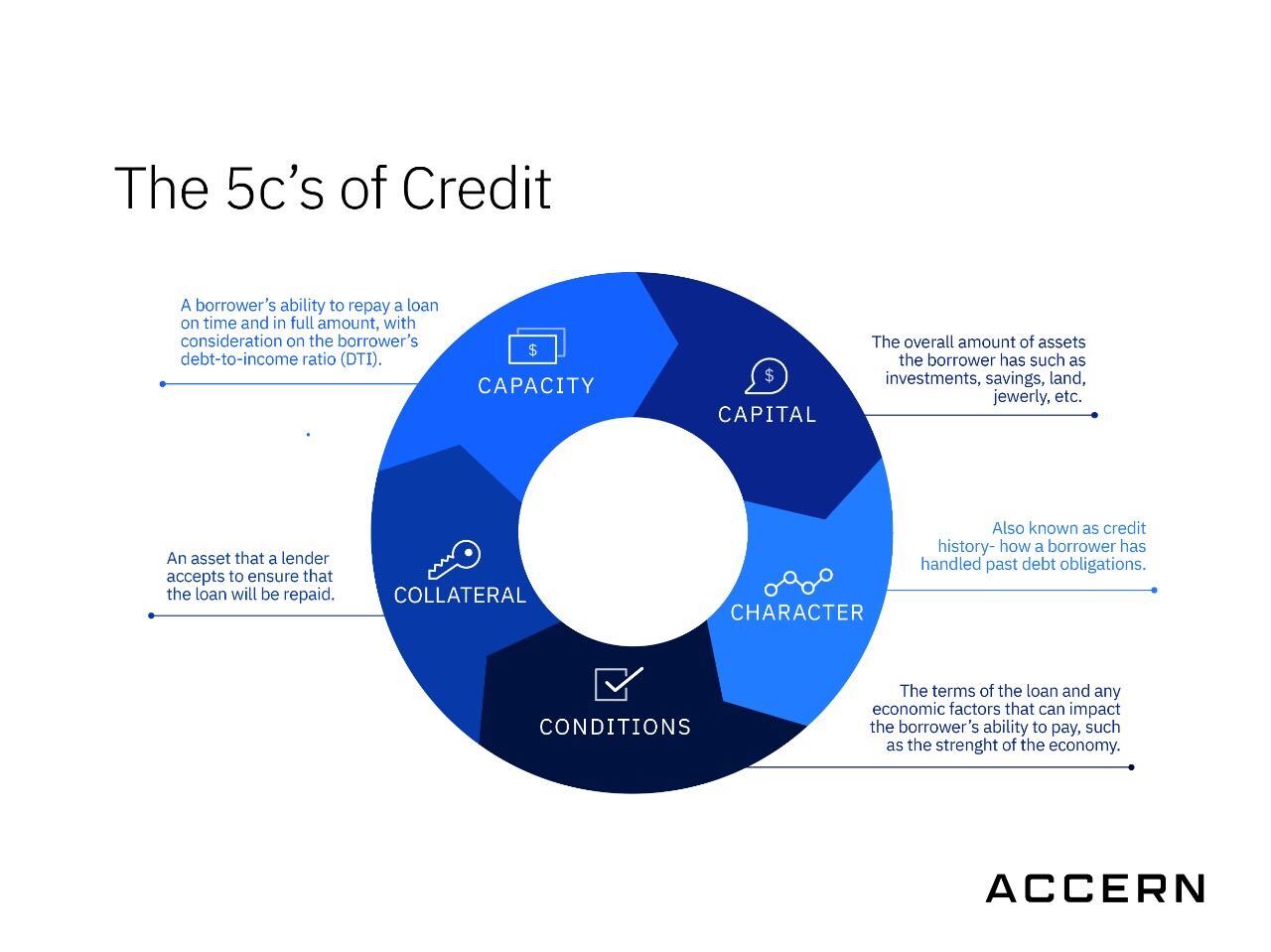

By monitoring potential and current borrower's credit risk, the financial firm manages the risk of its borrower on defaulting on payments so that they can act quickly in the financial institutions' best interest. Financial institutions often use the five C's to evaluate risk: credit history, capacity to repay, capital, the loan's conditions, and associated collateral. Both structured and unstructured data are often researched and analyzed to identify each of these C's from sources like credit rating bureaus, news, and public information.

Unstructured Data in Analyzing Credit Risk

80% of data today is unstructured and is projected to grow at 55-65 percent each year, creating more obstacles for analysts to uncover the right insights. Credit analysts face challenges in researching large sets of data and extracting relevant information to obtain accurate credit insights. The data collected from credit rating bureaus is often not enough to get a complete view of potential and current borrowers' credit risk. Furthermore, news is constantly changing, and analysts can miss important, real-time information.

The main challenges of identifying credit risk include the heavy, manual and time-consuming processes involved in monitoring all existing counterparties, the inability to identify events in a timely manner, lack of critical information on small to medium-sized businesses, and too much information on public companies.

Credit Risk Assessment Challenges

Assessing credit risk is at the discretion of the credit risk analyst. However, finding the right insights from piles of unstructured data in various sources often lead to several challenges including:

- Time-consuming and labor-intensive: Credit analysts must spend hours and sometimes even days manually monitoring the credit activities of all existing counterparts and key service providers.

- Real-time monitoring: It is often challenging to identify events in a timely manner and understand the potential impacts before detrimental effects have been realized in the market.

- Not enough information: There is often a lack of information for small medium-sized businesses. In contrast, for public companies, there is often too much information to analyze across too many sources. Therefore, critical information can be missed in the assessment process.

- Analysis: Analysis, usually, is based on the use of static sources such as credit ratings and annual financial statements.

- Incomplete Data: Attempting to combine traditional information (public, financial, corporate, among others) with alternative information such as key market events and company news without a standardized, automated process.

How Banks and Lenders Navigate Around Unstructured Data

Traditionally, financial institutions such as commercial and investment banks, credit card companies, credit rating agencies, and investment firms relied on analysts and data scientists to perform manual research and analysis to obtain the right insights.

Since news is constantly changing, credit analysts must actively monitor the credibility of securities, companies, or individuals to determine the likelihood that a borrower can repay their financial obligations in real-time. Analysts will review the borrower's credit and financial history to determine whether the subject's financial health and economic outlook are positive.

When analyzing the potential borrower's behavior and credit history, analysts will interpret financial statements to determine whether the borrower has an abundant cash flow and good credit standings. This is called early mitigation as analysts try to identify early warning signals of any signs of deteriorating credit. For example, if a business client is struggling to pay its bills on time, it could indicate a decline in revenue and potential future bankruptcy, which may affect the bank’s assets, ratings, and reputation.

Credit analysts can also run a simulation to understand the potential impact a change in credit can have on the borrower. Economic changes caused by the environment, stock market volatility, legislative changes, and regulatory requirements are a few of the risk factors that analysts will keep in mind. After considering risk factors, analysts may recommend specific courses of action for the borrower to take such as suggesting a business loan or business credit card.

Obtaining clean data is a critical component of determining the level of risk involved in lending to a potential borrower. If the bank proceeds with the loan approval, the credit analyst will continue to monitor the borrower's performance to ensure that banks have the correct information to act fast and mitigate risk. Based on what the analyst interprets, he or she may issue recommendations such as reducing the loan or credit limit, switching to a new credit card, or even terminating the loan agreement.

Determining the level of risk on a loan, credit card, or investment helps banks manage risk.

Credit risk analysts are critical in the process of addressing risk. Analysts are the first line of defense in managing and monitoring the credit risk of a pool of clients. Their main objective is to determine if a company is at risk of default. Additionally, analysts will ensure payments are on time and monitor activities to protect the financial institution from the borrower/insured defaulting. Find out how Fundomate, a lending company, used a no-code AI platform to manage risk in this case study.

Using AI for Risk Management

While most market events can be detected by movements in indices, CDS spreads, and more, detecting potential events in a timely matter can help manage risk by preventing the bank from lending to a borrower who won't be able to repay the loan. Besides detecting events in certain sectors or regions, banks can benefit by obtaining early warning signals on events impacting the individual portfolio companies before detrimental effects have been realized in the market, which can be further incorporated with sentiment analysis.

Banks and lenders can implement AI strategies to monitor data in real-time from news sources, social media, financial news, and more. The insights gained from AI's natural language processing (NLP) can lead to revealing early indicators of potentially detrimental events to individual companies, sectors, or regions. The indicators can be prioritized by relevance and enable users to highlight potential risks.

Accern offers a no-code AI platform that enables data teams within financial services to build AI solutions that unlock insights from their structured and unstructured data. Data teams can use a number of ready-mades, finance-specific use cases or can build custom use cases to gauge a specific company's or borrower's risk.

Accern's AI credit risk solutions are specifically built to enhance the credit risk team's and analyst's ability to monitor and make assessments of the company's credit risk by using AI to identify, quantify and provide early warning indicators of a company’s deteriorating health.

Data teams and analysts can use AI to identify credit signals, create early warning indicators, and improve research efficiency as discussed below:

- Credit Signals: Users can run real-time use cases, which monitor news, financial filings, and news on specific companies in real-time. With NLP models like sentiment analysis, adverse content can be identified for a specific company, industry, or region based on bankruptcies, default, debt restructuring, rating downgrades, and more. Based on the insights gained, signals can be created to help analysts further identify areas of potential risk and distressed companies.

- Early Warning Indicators: Early warning indicators can help lenders gain critical insights into a company's health and the industry in which it is serving. By combing the credit signals with the correct market data, users can forecast the potential credit deterioration before a significant credit event occurs. With AI and automation, lenders can stay on top of counterparty and credit risk at all times, without the intense manual research and monitoring that is usually involved by analysts.

- Research Efficiency: Research efficiency can be improved through the use of AI. AI models cut down significantly on credit analysts' time spent on company research and monitoring activities for both public and SMEs. Accern provides a simple user interface that enables users to easily filter credit signals and deploy adaptive NLP models which classify entity, theme, and documents and analyze sentiment and relevance within the data. This enables data teams to eliminate 99% of the noise found in data and improve their search results for specific content.

The applications of AI are still emerging and not all lenders are using this process within monitoring credit risk. Like with any new strategy, implementing AI can be difficult, time-consuming, and more costly than anticipated. In addition to the technical challenges, industry resistance can implicate the process as well.

Improving Counterparty and Credit Risk Management with No-Code AI

No-code AI may provide a more efficient, cost-effective solution for banks, lenders, and credit rating agencies. No-code platforms like Accern offer ready-made (out-of-box) AI solutions. Users can also create custom AI solutions by retraining any of the ready-made use cases. Accern offers a data store on the no-code AI platform so users can identify credit events from global and local news sources, corporate filings, company transcripts, investment research and more about a business entity. Users can then assign a credit sentiment score based on the strength of adverse credit signals.

All of these no-code AI technologies cut down on lengthy AI development cycles and eliminate the need for large data science teams.

Additional Benefits of No-Code AI for Counterparty and Credit Risk Management

The benefits of implementing no-code AI to monitor counterparty and credit risk bring tremendous ROI through managing risk, identifying potential default, and acting before it's too late. In addition to increases in ROI, no-code AI benefits the front, middle, and back-office operations of a bank by:

- Reducing the time to credit decisions by automating credit risk assessment processes.

- Improving the prediction power of credit risk models or easily designing new credit risk models.

- Reducing credit loss by recognizing emerging risks and potential downgrades early on.

- Providing customers with tailor-made products or solutions based on their level of risk.

- Obtaining hidden insights from private companies or SMEs.

- Improving the deployment and utilization of risk and assurance resources.

To learn about how no-code AI has enhanced risk management for a lender, view our Fundomate case study.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com or submit the demo request form below.