Top 5 Barriers to AI Adoption Within Financial Services

Across the industry, financial services firms are adapting to the modern world and embracing AI adoption to stay competitive and optimize efficiency. Despite the countless benefits of using AI and machine learning in operations, the financial services industry as a whole remains behind in AI adoption as many firms encounter barriers to implementing AI into their business.

Worldwide, nearly 40% of business owners cite the cost of technology as the main reason for AI adoption hesitancy. Still, there are numerous other barriers to AI adoption for financial services firms today. AI programs can be very technologically advanced and require adequate maintenance and storage facilities, in addition to the skilled labor needed to run and assess insights from the model day-to-day. Given the rapid pace of technological advancement today, it is more important than ever that financial services firms overcome the obstacles to AI adoption to stay up-to-date and relevant in the field.

Overcoming AI Barriers

Firms have found many uses for AI and machine learning within the financial services field to improve the customer experience, automate tasks, cut costs, and see better efficiency. From streamlining the insurance claims process for customers to helping banks with risk management and credit decisions, AI is reshaping the industry and assisting firms in putting their resources to better use.

Given the technological complexity of AI models and the regular testing and storage requirements needed to keep the system running correctly, it is no surprise why firms may experience barriers to AI adoption. Hiring a specialized professional in data analytics or computer engineering may be out of the question for many companies in the space. In contrast, others are unsure how to retrain current employees to handle this task.

Despite the obstacles firms face when considering AI adoption, there are ways to overcome each barrier and successfully integrate AI and machine learning into their operations. Through better education and transparency around training the AI model to perform tasks, companies can improve trust in AI for those both internal and external to the company. Additionally, with a clear plan for AI implementation, financial services firms can ensure they have the right talent and infrastructure for AI adoption to succeed.

5 Barriers to AI Adoption

Between storage requirements and the need for skilled workers, business leaders may be intimidated by the process for AI adoption into their company. Plus, given the complex nature of AI and machine learning, it may be hard for consumers and business leaders to be fully on board with AI integration. Not having a clear strategy for what the AI model will accomplish or having doubt within the company over the validity of the model's recommendations can all be added barriers. However, there are remedies to each setback that can ensure successful AI implementation for financial services firms.

Enterprise maturity

Companies of any size or stage can see successful AI integration into their operations, though there may be added work for a more advanced or established business. Successful AI integration involves sophisticated storage architecture and ongoing maintenance and updates that may not be supported by an established company's existing hardware, leading to further costs.

Since it can be a significant undertaking for an established firm to pursue AI integration, it's possible that the time and money invested will be great enough to detract from core operations and competitiveness in the short term. While AI adoption is crucial to the longevity of businesses today, firms may not be able to look past the immediate AI barriers and forgo further integration.

To curb the potential costs of overhauling the existing architecture of an established company, the firm can choose to implement AI through phases, ensuring the success of the integration over time without a significant upfront financial burden. Starting by assigning smaller tasks to AI and gradually working towards greater use cases is an effective way to integrate AI into an established business.

Talent shortage

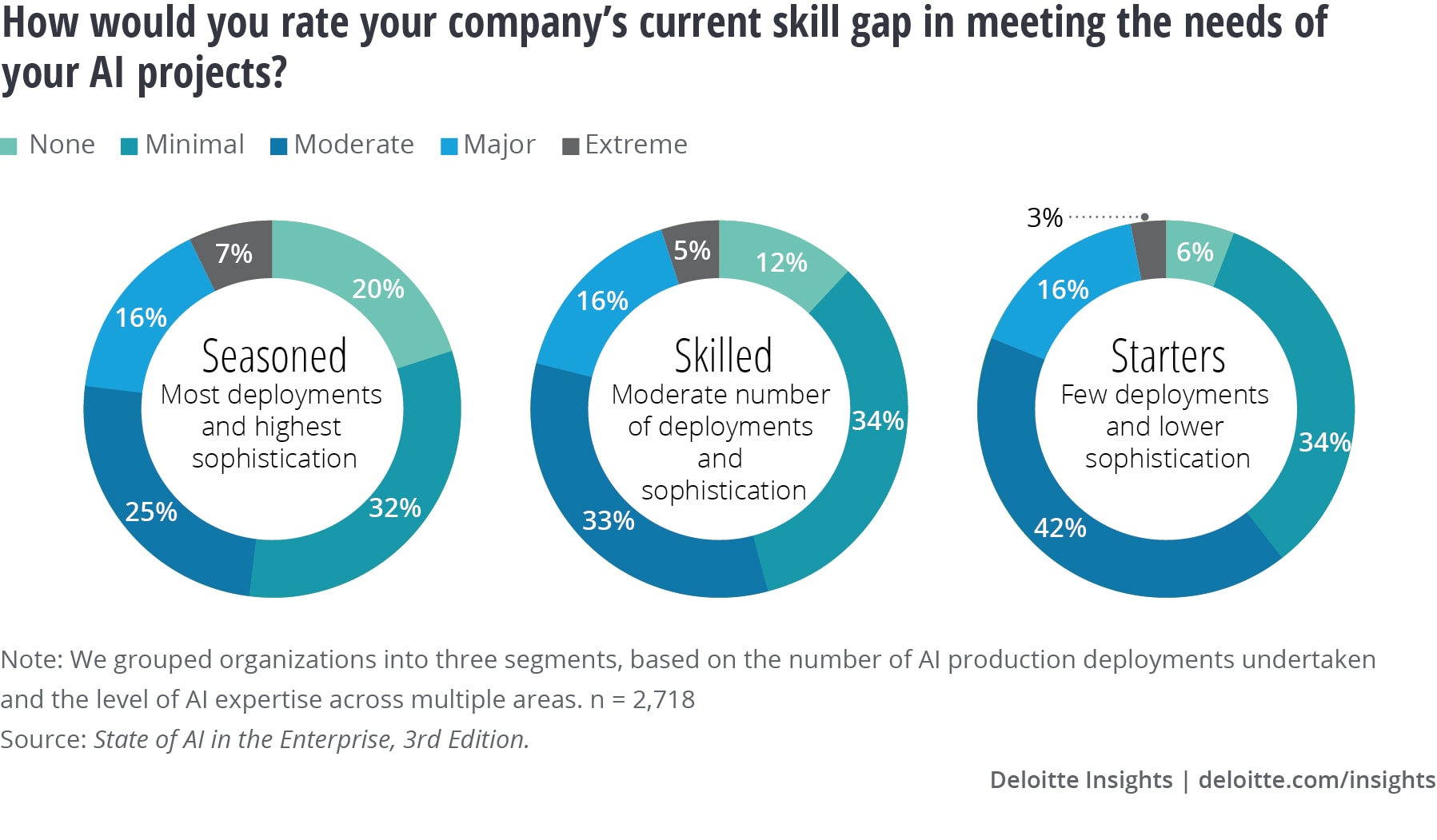

Considering the technological complexity of AI and machine learning, many models require skilled workers to maintain the system and help interpret the insights gained on a day-to-day basis. Though AI adoption is on the rise today, there is still a shortage of trained AI professionals across all industries with at least 23 percent of mature AI adopters stating a major or extreme AI skills gap, adding a barrier to further integration.

Even still, many financial services firms may not have the capacity to hire a highly sought-after data analyst or computer programmer, given their high demand today. It was recently noted that 56% of business and IT leaders believe that increased AI adoption will make it necessary for employees in both new and existing roles to acquire new skills to work alongside AI. So, whether employees are immediately working on the AI model or not, further AI adoption is likely to impact workers at all levels.

Over time and as AI adoption ramps up across industries, more people will become trained for careers in AI as the overall market grows and demand for these workers remains high. This will help alleviate the talent shortage in the coming years and decades, though there is still an immediate need for skilled workers in AI. Because of this, firms may identify current employees who show interest in AI and are willing to pursue further training to become well-versed in the field and help the company accelerate its AI adoption.

Not setting a strategy

By 2024, 50 percent of all AI investments will be linked to key performance indicators to track its ROI. Thus, the need for a clear strategy for what the AI program is trained to accomplish will become increasingly crucial as further AI adoption across the industry occurs.

Choosing the right area of application for AI models is an involved process that requires the company to consider its long-term vision and the practical uses of AI in the business. Within the financial services field, the needs for each business differ, meaning each company will have its unique use for AI according to its broader mission.

Financial services firms want to ensure they're getting the most out of their AI investment, so companies must set out a distinct strategy for implementation, expectations, and ongoing upkeep to see successful AI integration. Having a clear idea of what the firm wants the AI model to accomplish and ensuring that it's aligned with its long-term goals are beneficial to the ongoing success of AI integration and ROI optimization.

Organization wide buy-in / company cultural resistance

For an established business, it may prove challenging to convince tenured employees to change the systems and processes they have used for years in favor of a computer-based program. Thus, financial services firms must receive company-wide support over AI integration initiatives for its adoption to be successful.

Change is hard in any industry, particularly in the financial services field, where technology adoption has historically been slow. Additionally, certain employees may feel threatened by greater AI adoption and worry that their position is at risk of being replaced by such programs, leading to potential resistance around further integration.

Though it may be clear to investors and technology professionals why AI adoption is crucial to a company's future success, that may not be the case for employees at all levels and skillsets. As such, all stakeholders in the company must understand the value-added from using AI, which will make its integration into the company much smoother. Company leaders can also ease hesitancy by explaining that AI won't replace employees; instead, their positions may become easier with the help of these programs and allow them to focus on more exciting and less repetitive tasks.

Fear

Above all, AI models are complex and constantly change and adapt to the data input. This leads to the black box problem or the mystery around how AI works and produces its recommendations. Without a clear idea of how AI makes decisions, it is hard to build trust in the system, leading to fear of the unknown among business leaders and consumers.

Between fears about their jobs being replaced by AI systems or the uneasiness about potential errant recommendations and bias from AI models over human decision-making, there is no shortage of hesitancy among business leaders and consumers about the increased use of AI across the financial service industry. AI adoption isn't slowing down anytime soon, but further integration could be accelerated once these fears are mitigated.

By educating employees and clients about what problem the AI model is trained to solve and being able to justify its recommendations, financial services firms can handle this barrier. The more familiar people become with AI-based solutions, the less fear they will have around its increased adoption into the industry.

How No-Code AI Can Help Financial Services Overcome AI Barriers

Despite the various potential barriers to AI adoption for financial services firms, it can still be practical for businesses of any size to benefit from an AI integration. With advancements in technology, financial services firms now have access to solutions that help reduce barriers to AI implementation while reaping the benefits of AI through the use of a no-code AI solution, like the one offered by Accern. Using Accern, companies do not need to hire a designated data analyst or computer programmer; instead, financial professionals at any level can access insights from AI models without the added complexity of building them from scratch.

Accern provides the architecture for AI through its no-code AI platform offered for financial services firms. Firms can deploy AI models securely on a SaaS (software-as-a-service) or cloud platform. It is constantly updated with the latest data and trends, making its database valuable and relevant to professionals in the field. Additionally, financial services firms can import their own data and train models specific to their use case needs. Accern gives users an edge over competitors with quick access to insights that would normally take days to uncover. Financial services firms can see the automation and research and analysis advantages no-code AI can bring to their business by seeing a live demo of the Accern platform - get in touch below!