Quantitative analysts must consume and process large volumes of data through statistics, information models, and computer simulations, to study the behavior of stocks and create trading signals. The goal of quants is to observe historical quantitative relationships and incorporate the relationships into complex mathematical models and find alpha, or excess returns, in investment opportunities. One of the major obstacles that quants face is filtering out the noise in data that is constantly generated. Let's take a look at the unstructured data challenge for quants.

Why is unstructured data a problem for quants?

Quantitative hedge funds must search through both historical and real-time data to create accurate predictions on stock movement. By studying a company's past data up to the present, quants have a better chance of creating accurate investment signals and finding alpha. However data is being generated by the second and the IDC estimates that 90 percent of all digital data is unstructured content, which creates a barrier in identifying stock movement trends within an industry or for a company.

While structured data like credit card transactions, geolocations, and satellite imaging data is organized in tables and columns making it easier to digest, unstructured data such as earnings , transcripts, conference audios, images, and raw content from the internet are difficult to analyze. Quants must use both structured and unstructured content, however, to reveal trends, patterns, and associations within a company's stock performance. Due to the text-heavy, undefined information in unstructured data, critical information is hidden and often overlooked.

As unstructured data continues to grow at 55-65 percent each year, quants will continue to face challenges in researching large sets of data sets and extracting relevant information to generate alpha. However there is a solution to this unstructured data problem.

How can quants use AI to structure unstructured data?

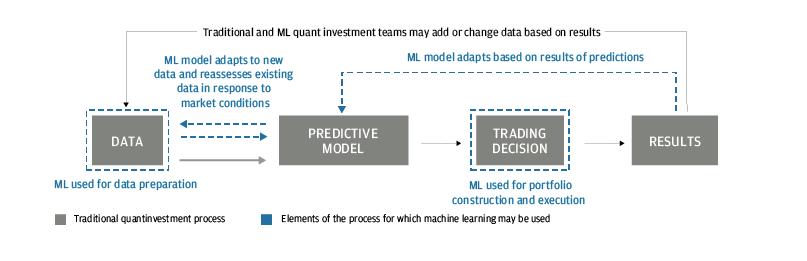

Source: J.P. Morgan Asset Management

Quants can use AI to automate the processes of researching, identifying, and extracting data with intuitive workflows, which can help them identify investment and risk decisions quickly with more accuracy. Machine learning is a subset of AI that studies computer algorithms to improve the automated processes from researching and extracting data. Both AI and ML can be used to automate, evolve, broaden and deepen the quant investment process.

Quantitative management firms spend significant amounts of time and money trying to process large amounts of data and predict stock movement. Globalization, technological innovation, and new data creates noise and overcrowding when trying to identify alpha. AI can be a vital tool for any quant looking for quick and accurate insights without all of the manual-heavy and time consuming processes of research.

NLP is another subset of AI that enables computers to read text, hear speech, analyze it, measure sentiment and determine which elements are important. With the traditional methods of research, it is increasingly becoming impossible to create accurate, actionable signals for quantitative investment strategies. Additionally, without being able to consume and quantify the impact of it quickly and at scale, quant managers will be left at a competitive disadvantage. However, monitoring corporate news and events with AI can positively impact quants’ strategies and systematic processes in creating alternative data sets and building accurate investment signals.

How can quants use AI to find alpha?

The market for AI in quantitative management continues to grow as quants turn to alternative data, which is data used to obtain insights into the investment process, to find and maximize alpha returns. Quants can use AI to analyze large amounts of information and reveal trends, patterns, and associations within stock movement. Through AI, NLP can enhance quantitative analysts' systematic strategies and processes in building:

- Alternative Datasets- Quants can create alternative datasets with custom indicators such as sentiment, relevance and impact scores. By searching within a large collection of sources such as news, blogs, research reports, transcripts and corporate filings, and internal sources, quants can build investment signals and alpha indicators. Investors can then use the analyses for more accurate, faster, and specific insights and metrics into company performance than with traditional data sources.

- Automatic Algorithms- Quants develop algorithms to support traders in their day to day trading activities. Quantitative strategies include a scientific and mathematical approach to building out algorithms. Algorithms guide traders to make certain decisions (e.g., when x happens, do y). While traditional algorithms require programming and mathematics, the if/then rules must constantly be updated as they cannot learn on their own. However, machine learning takes out the complexity of coding, math, and science by identifying patterns and behaviors in historical data and learning from it. AL can also schedule algorithm execution by identifying trends to maximize on alpha.

- Investment Signals- Once algorithms are trained and ready to be deployed, then next step is to test the algorithm on live market data and generate real investment or trading signals. Quants will feed the algorithm as much data needed, and the algorithm will send a signal that gives insight into when a trader should buy or sell. With AI and ML, investment signals will automatically be generated based on the alternative data and algorithms. The insights a trader would gain from the investment signal are when to buy and sell, an entry price, a stop loss price and target price.

Traders can become overwhelmed by stock volatility. Volatility causes inconsistencies in buy and sell signals which can cause turnover, high commissions, and taxable events. AI insights allow quant managers to navigate through the noise in structured and unstructured data, automate algorithm decisions, and build trading signals.

How can quants use no-code AI?

With the advancements of AI and ML tools, we were able to develop a no-code AI platform at Accern, enabling financial analysts and data scientists and engineers to use AI without having to code. Quantitative management firms can now implement AI and ML easily and quickly to enhance efficiency and productivity across the quantitative value chain.

With new technological advancements and the excess amount of data available, the code-heavy, manual work for quants can be challenging. Once a quant passes the phase of building algorithms, the process of constantly updating the algo with new data can be overwhelming. No-code AI supports quants' work in building alternative data sets, algorithms, and trading signals without the complex coding, mathematics, and statistics strategies.

AI and ML in quantitative trading strategies is gaining momentum as investors are now using these tools to trade in financial markets, making it difficult for industry leaders to ignore. Although challenges and risks remain, investors who can combine the power of these tools with quant and strong portfolio construction strategies can significantly improve portfolio outcomes. The time consumption, cost factors, and expertise needed in creating and training AI models are still obstacles to AI adoption. However, no-code AI, enables financial services enterprises to adopt artificial intelligence quicker.

To learn more about how you can use AI to find alpha, download our free e-book today on AI for Quantitative Analysts.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com