5 Artificial Intelligence Challenges Businesses Face

Grace Kim

May 4, 2021

As artificial intelligence (AI) is emerging within many industries, innovations in the field are growing exponentially. Corporate spending on AI was set to exceed $50 billion last year, according to the International Data Corporation. This blog post will cover the top five artificial intelligence challenges businesses face.

Financial firms are increasing the adoption of AI and machine learning to capitalize on structured and unstructured data from digital sources. As unstructured data grows exponentially, financial firms are finding it difficult to maintain their traditional workflows, which often uses manual research and analysis tactics.

According to a research report by Economist Intelligence Unit (EIU), 86 percent of financial service executives state that they plan on increasing AI-related investments throughout the next few years. Furthermore, the study, which analyzes the sentiments of over 200 executives in the financial services industry, reveals that investment banking firms are leading the way in adopting AI and machine learning, followed by retail banking.

The IDC projects that by 2024, $110 billion will be invested into the AI field. Organizations that utilize AI are 7x more likely to grow faster than other businesses in their industry. However, implementing AI remains a challenge for many firms. To successfully implement AI, financial firms must overcome the challenges they face in data complexity, industry resistance, limited knowledge, shortage of talent, and a lack of trust in AI.

Challenges Businesses Face in Implementing AI

Implementing any new strategy can be difficult, time-consuming, and more costly than anticipated, especially when dealing with new technologies and tools. In addition to the technical difficulties that financial firms may face, staff and environmental factors can make the process of AI adoption more complex.

Here are the five top challenges that financial firms face when implementing AI:

- Data complexity- Data comes in all types of formats and structured. It can be retrieved from multiple sources and in formats like text, audio, image, numbers, and video. For anyone who has tried to solve a business problem with real-time data, we know that it can extremely painful and complex. Obtaining insights and delivering value from data is difficult because data is messy. The complexity and amount of data are challenges for businesses trying to implement AI. A large amount of high-quality data is needed to train AI models in order to obtain the right insights and transform them into solutions.

- Industry resistance- Technology is changing the way we think, work, and communicate. Studies show that machine learning and artificial intelligence are expected to grow exponentially over the next 10 years and beyond. Despite the growing evidence that AI can help businesses achieve greater success quickly, there is still cultural resistance to embrace AI within financial services due to the widespread lack of understanding about the potential benefits artificial intelligence can bring to solve real-world business problems. According to the "AI2020: The Global State of Intelligent Enterprise" report by Intelligent Automation Network, 49% of corporate leaders state that the biggest corporate challenge in implementing AI and automation in the business strategy is cultural resistance.

- Limited knowledge- To successfully implement AI, it requires a clear strategy with identifying areas that need improvement, setting clear objectives, and ensuring a continuous process for improvement. Additionally, a large volume of data is required for a successful AI initiative. Although customers are aware of AI's abilities to provide better customer service, most leaders are uncertain about AI's benefits in business. According to survey by Gartner, forty-two percent of executive leaders stated that they do not fully understand the benefits and use of AI in the workplace. Business and IT leaders face challenges in defining and quantifying the benefits of AI in ROI, time-saved, customer experience, and accuracy.

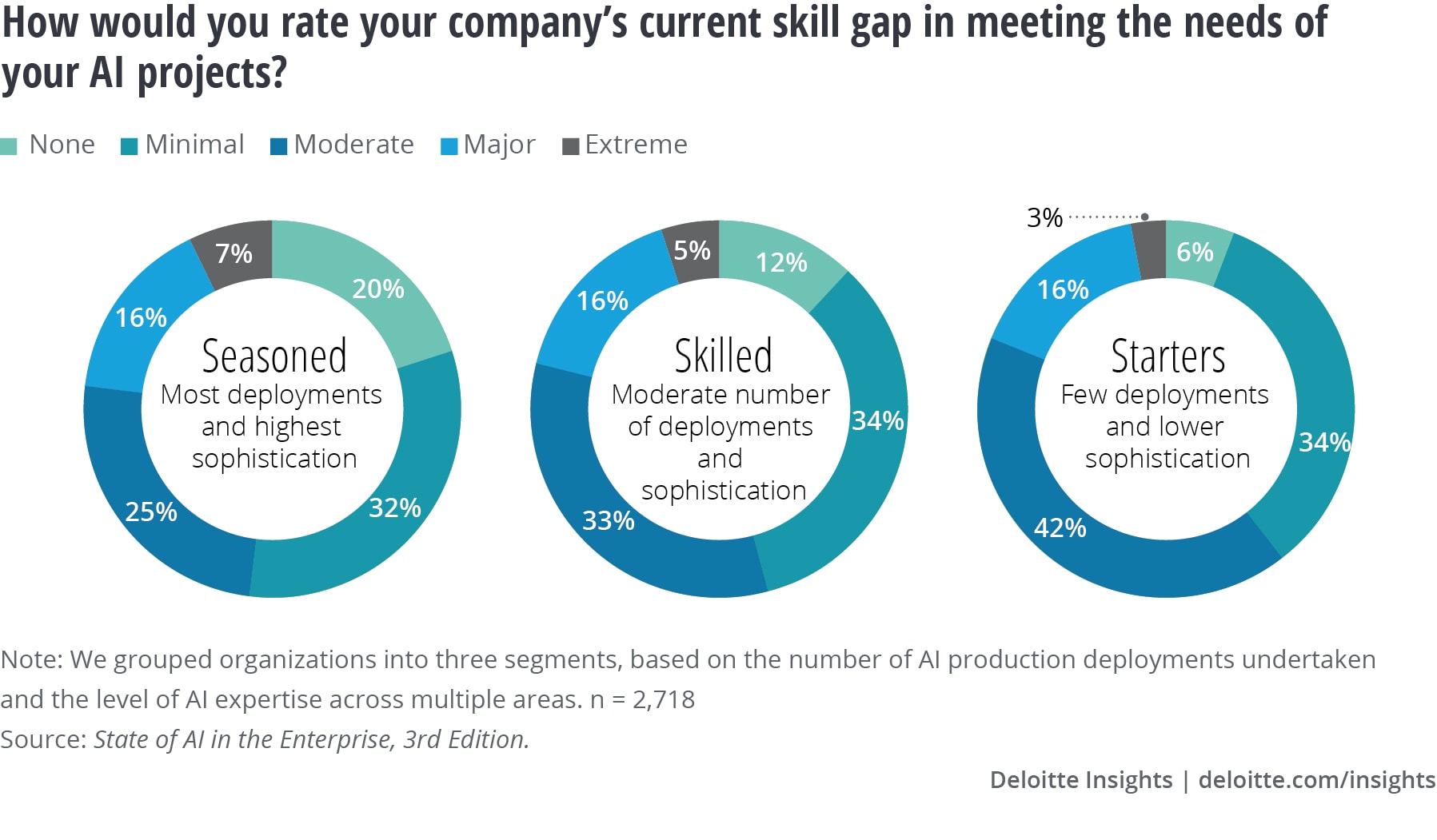

- Shortage of talent- Despite companies employing AI specialists more quickly than ever, they are facing a major skills gap when it comes to meeting the needs of their AI projects. According to The 2018 Future of Jobs Report, by the World Economic Forum (WEF), 133 million new jobs will emerge from AI and automation by 2022. However, a study by IBM Institute for Business Value states that as many as 120 million employees across the world will need to be retrained as a result of AI. 23 percent of companies state that one of the main challenges of AI adoption is that they are experiencing a major skill gap at every level of AI implementation.

As new technologies are reshaping the way business and life works, industries are looking to implement AI into their business workflows now more than ever. However, degrees, certificate programs, and trainings in AI are not as established and have not been around for long periods as programs in business, finance, or marketing. Therefore, hiring managers either need to find experienced AI professionals from outside of their organization, partner with other AI companies, or hire university graduates in AI and train them internally.

- Risk and ethical concerns- AI provides innovative solutions in providing better customer experiences and capitalizing on structured and unstructured data, especially within the financial services industry. AI can use Natural Language Processing (NLP) techniques to make human-like decisions quickly and efficiently. However, AI also comes with serious risks and ethical complications. One of the major concerns of AI is data leakage and misuse. Cyber and political threats arise with the growth and reach of AI capabilities. For example, the 2014 Facebook scandal where data on 87 million users were collected and handed to a political consulting firm, highlights the risk that corrupt data practices can bring to a firm.

Tips to Overcome the Challenges of AI Implementation

Despite the positive implications businesses can achieve, the challenges that come with implementing AI prevent financial firms from adopting AI. However, businesses can avoid many of the challenges listed above by ensuring certain processes and creating a clear path to AI adoption. Here are a few tips to overcome the challenges of AI implementation:

- Ensure data quality- A large amount of high-quality data is needed to develop accurate algorithms. High-quality data can drive the value of the data and impact several aspects of the business outcome like risk management, customer satisfaction, and accuracy. Although the standard for good quality data differs across industries and use cases, financial services can increase the quality of their data by ensuring the data is accurate, valid, consistent, complete, standardized, available, and trustworthy.

- Promote transparency about AI across employee and executive boards- Despite AI's positive implications, there continues to be a lack of understanding about the potential benefits AI has in solving real-world business problems. To support executives and employees in their journey to an AI-first world, leaders can develop a roadmap to guide high-level conversations and discussions about AI's value and ability to impact business outcomes. By educating the entire workforce about AI with empathy, leaders can overcome the cultural resistance to AI adoption.

- Consider no-code AI- AI is complex and companies are facing a major skills gap in AI-specialized roles. As innovations in technology continue, the capabilities of AI will broaden and continue to advance. However, a shortage of AI specialists does not need to be a barrier for financial services to adopt AI. No-code AI tools enable end-users with some technical experience to create their own AI models quickly and efficiently, bypassing IT. Financial firms experiencing a shortage of talent can become agile, more efficient, and empower their current employees by implementing no-code AI into their infrastructure.

- Ensure data compliance- Data leakage and misuse is a major concern of AI within financial services. Financial firms can start off with a small set of complex data to build AI systems. They can then add subsequent ones after ensuring that there aren't potential issues in the implementation stage of the project. Data should also be stored in a specific and secure space to prevent data leakage. With successful implementation, AI can actually be used to ensure data compliance by automating the process to collect, validate, analyze and share data for reporting requirements.

A no-code environment allows technical and non-technical end users to implement AI in their processes quickly and easily. Through simple commands and an easy-to-understand user interface, end-users can realize the benefits of automation without time delays or manpower requirements. A no-code environment can advance the use of AI through the front, middle, and back office operations by improving efficiency, freeing up technology teams' time, improving business functions' RO,I and providing companies with a competitive advantage. For more information on AI within financial services and an example of how AI can be used within asset management firms, download our free e-book.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com