How Investors Use Sustainable Development Goals for Impact Investing

Sustainable or impact investing is a strategy investors use to invest in companies that practice habits that promote sustainability within a social, environmental, or governance concept. Research shows that companies with stronger sustainability initiatives provider higher, long-term returns, in addition to making a positive impact on the world. The Sustainable Development Goals (SDGs) were formed by members of the United Nations to provide a clear and measurable framework on the progress of sustainability and human rights as a whole. Read on to find out how investors use the sustainable development goals for impact investing.The SDG’s provide a way to understand and measure investors’ real-world impact. It’s a way for socially responsible investors to demonstrate how incorporating such issues as climate change, limiting war making capabilities, and working conditions into their investment approach are contributing to a more just, peaceful, and sustainable world that we want to leave to future generations.

How investors use the SDGs as a Framework for Impact Investing

Impact investments are investments made with the goal to generate positive, measurable social and environmental impact while receiving a financial return. Depending on investors' strategic goals, impact investments can be made in emerging and developed markets and target a broad range of returns.

The impact investment market continues to grow as it provides capital to companies committed to addressing the world's most pressing challenges. Companies actively supporting renewable energy, sustainable agriculture, healthcare, education, clean water, and conservation within their operations are a few of the criteria that are popular among investors looking to build well-rounded portfolios with impact or ESG investments.

The Global Impact Investing Network (GIIN) is a nonprofit organization committed to increasing the scale and effectiveness of impact investing. According to the GIIN, more than half of impact investors worldwide in 2017 used the SDGs to measure some portion of their impact performance. This number has grown significantly as interest in impact investments has increased.

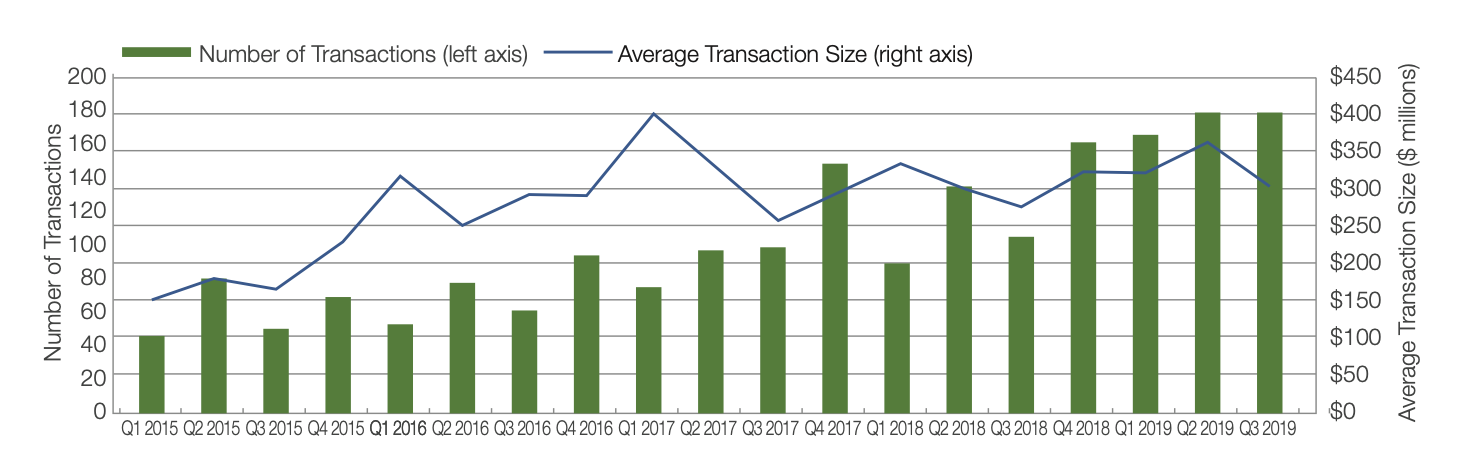

According to a report by the Forum for Sustainable and Responsible Investment (US SIF), investment management firms and institutional asset owners cited that the SDGs are a motivating factor for sustainable investing strategies in 2020 and beyond. In addition, the report, "Investing to Achieve the UN Sustainable Development Goals: A Report for the US Investor Community," noted an increase in green bonds and other asset classes with sustainable development themes, including private equity. The SDGs are transforming the way that investments are being made across private equity, fixed income, asset management, and other investment management areas. The figure below shows the growth in green bonds from 2015 to 2019.

Source: Moody's Investor Services

According to the 2020 UNCTAD World Investment Report, in 2019 green bonds grew rapidly to nearly $260 billion, a 51 percent increase. Green bonds include investments in three SDG goals, climate action (SDG 13), affordable and clean energy (SDG 7), and sustainable cities and communities (SDG 11) and are primarily used in energy, buildings, and transportation.

The SDGs continue to encourage the financial services industry and investors to examine investment strategies in companies through another lens - one that promotes equality, freedom, and sustainability, reduces climate change, and provides generous financial returns. Recent analyses, also reported by the Harvard Business Review, consistently show that companies committed to sustainability within their operations are less likely to go bankrupt and more likely to provide higher financial returns.

Investing in SDGs also correlate with environmental, social, and governance (ESG) investments. SDG investments include integrating good ESG practices in business operations to ensure there is positive impact from investments. This is where stock exchanges come into play in promoting sustainability in capital markets as they provide a platform for sustainable finance and guidance for corporate governance.

The last decade proved pivotal for sustainable initiatives. Today, more than half of global exchanges provide guidance to companies listed on the exchange on sustainability reporting. Corporations and investors understand the importance of making decisions that will positively impact the SDG outcomes. However, the biggest challenge lies within obtaining quality and accurate insights on SDG reporting standards.

What are the SDGs?

In 2015 all United Nations Member States met at the United Nations Headquarters in New York and adopted the 2030 Agenda for Sustainable Development. The Agenda for Sustainable Development lays a blueprint for peace and prosperity for the people and the planet with the ultimate goal of strengthening universal peace and freedom.

In 2015 all United Nations Member States met at the United Nations Headquarters in New York and adopted the 2030 Agenda for Sustainable Development. The Agenda for Sustainable Development lays a blueprint for peace and prosperity for the people and the planet with the ultimate goal of strengthening universal peace and freedom.

There are a total of 17 SDGs and 169 associated targets which stemmed from the eight Millennium Development Goals (MDGs), a blueprint from 2000-2015 which guided global development efforts towards eradicating poverty and disease in developing countries. With measurable achievements like reducing the number of HIV infections by 40 percent and the malaria mortality rate by 58 percent, the success from the MDGs encouraged the UN to set a broader plan for the world from 2016 to 2030. The goal of the SDGs is to continue to tackle poverty, in addition to ensuring more equality, environmental sustainability, and economic development.

The milestones reached by the MDGs reveal that setting and defining goals are critical in bringing the world together to achieve social mobilization and sustainable development. The MDGs and SDGs connect individuals, organizations, and governments towards a vision of more freedom, sustainability, and equality. According to the Special Adviser

The SDGs provide a defined framework for companies to follow and contribute their own efforts to impact the world through 17 goals. In addition, they provide new investment opportunities for retail and institutional investors. Organizations like the Global Impact Investing Network (GIIN) are encouraging investors to use the SDGs as a framework in building and shaping their portfolios, and many institutional investors are now tracking their existing portfolios against these goals.

The long-term implications of the SDG's are that corporations will behave more ethically by providing a sustainable growth model. Additionally, the world will become a better place for humans and the quality of life will improve. Furthermore, research has shown that corporations that practice sustainability reap the benefits of long-term and higher returns. The SDG’s offer a clear and measurable level of participation in a global effort to maintain and progress the health of humanity as a whole.

Using AI to Obtain SDG Insights

As investors look to companies that are following SDG initiatives, how companies impact sustainable development and climate change are paramount to current and future investment and business decisions. As global data increases, the challenge for obtaining quality data around SDG actions becomes bigger. Artificial intelligence (AI) can help investors identify clean and accurate data around companies that are effectively furthering the SDGs.

When it comes to selecting sustainable investments, investors may track financial results, annual reports, and other statements to evaluate the actions that corporations are taking to further SDG goals. The main challenge investors face is the massive amount of data to sift through in order to identify whether corporations are really incorporating SDG practices within business operations. AI can help reveal hidden data around the 17 SDGs to bring investors more insights into a company's sustainability practices.

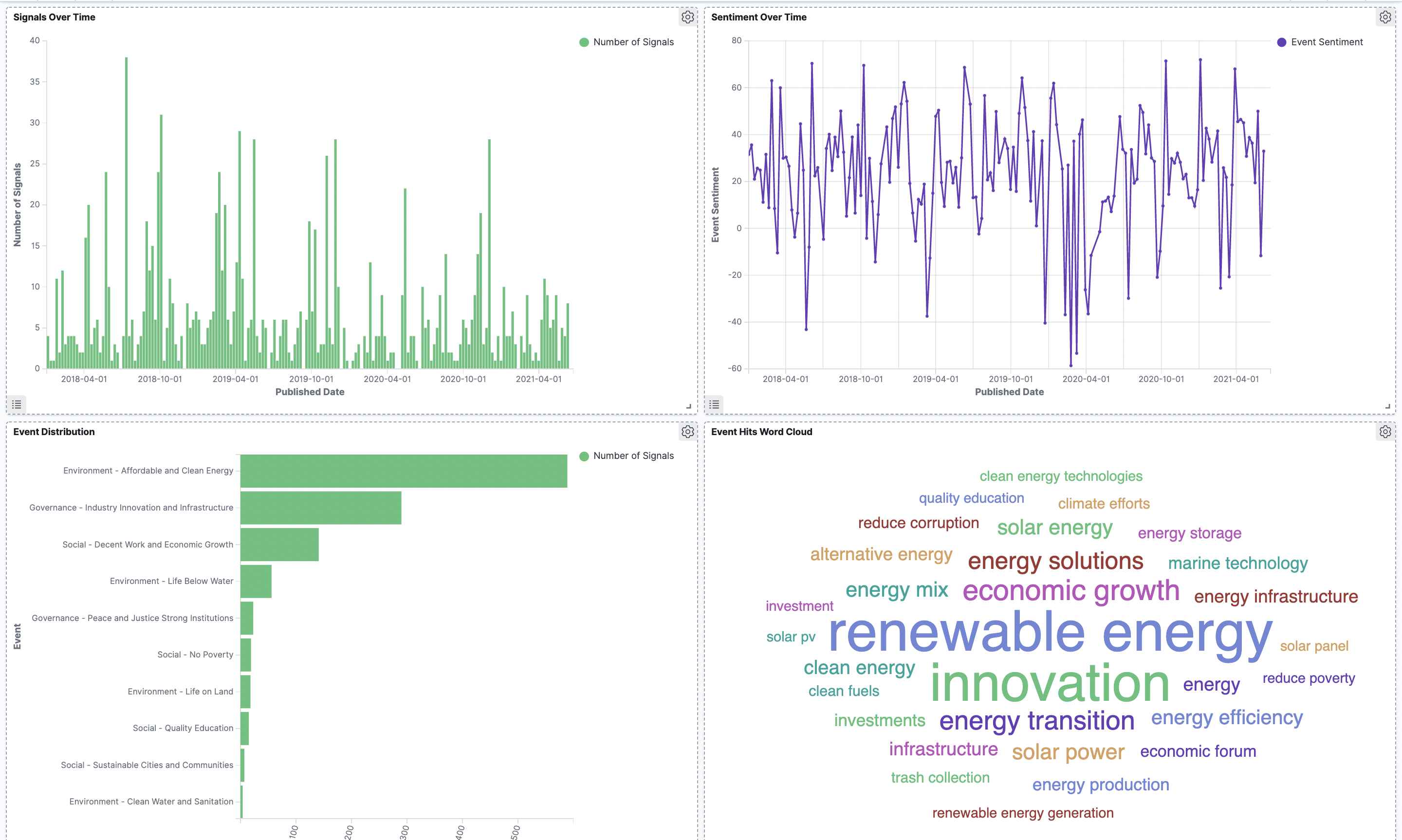

The image below shows how AI can extract specific words related to the SDGs from large amounts of data, track sentiment, and record the number of signals over time. These can be pulled from specific data sets and specific companies. Renewable energy, innovation, and economic growth are a few SDGs that companies are prioritizing according to the "Event Hits Word Count" image below.

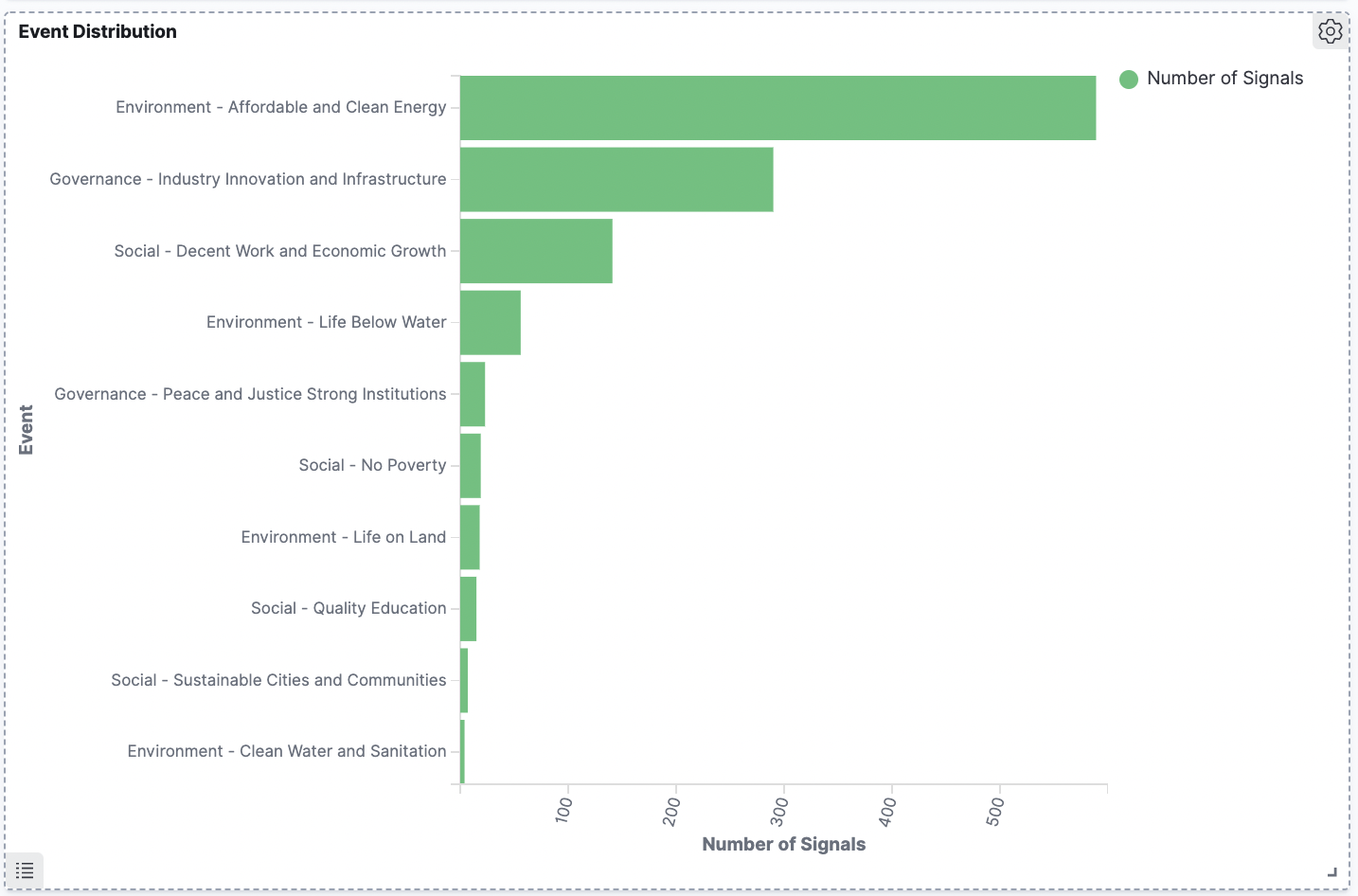

Financial analysts can use the information to identify the number of signals around a specific SDG. The image below shows the breakdown of the number of signals between different SDGs. For example, this image shows that affordable and clean energy is a priority for many companies within their business operations and has the most number of signals compared to other events.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com

For information on how AI can be used to identify a corporation's ESG practices, visit Using AI to Identify Corporate ESG Practices or request a demo below to see Accern No-Code AI in action.

Request a Demo