How does greenwashing affect ESG investments?

Environmental, social, and governance (ESG) investing is a form of sustainable and green investing that investors invest their money in companies that positively impact the environment, social life, and governance. ESG investing has become a hot topic worldwide, with more interest from investors than ever before in companies with solid sustainability initiatives. However, the lack of regulations has paved the way for greenwashing. How do investors know whether companies are being honest about their ESG initiatives?

How does greenwashing effect ESG investments?

Investors are interested in sustainable investments. Research shows that companies that practice sustainable initiatives perform better in the long run than companies that do not. For example, according to Morningstar, sustainable funds reached a record of $51billion, doubling in 2020 from 2019. How companies handle diversity and inclusion, the gender pay gap, climate change, and more are paramount to today's investment decisions.

While there are many sustainable funds and organizations out there, the sustainability of certain funds and companies are debated. A major critique of ESG investments is that there is "no such thing as a truly sustainable investment" and is instead considered "marketing hype."

Greenwashing is a term used in the financial industry where companies engage in marketing or public relations strategies to appear as if they are making a positive ESG impact. Instead of taking meaningful action against environmental, social, and governance issues, false claims are made about the sustainability of a company's products and services.

Greenwashing can be done by an organization and by a financial services firm to promote certain funds. Although some funds are sustainable, it is difficult for investors to know which funds impact the environment positively and take a stance on social and governance issues.

Now that ESG investing is becoming more popular, many firms and companies see the benefits of emphasizing ESG objectives. Financial advisers and investors should know which funds and which companies are actually in line with ESG practices.

How can greenwashing be avoided?

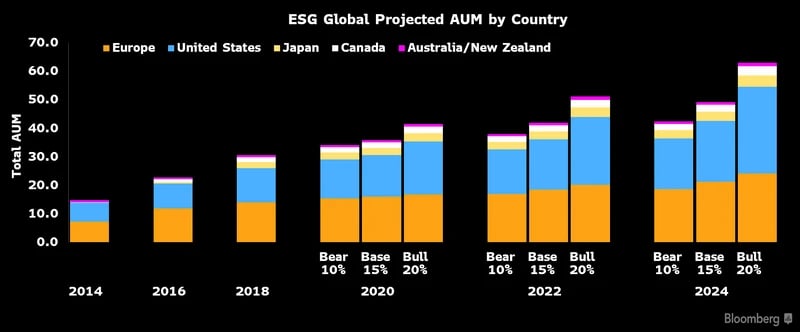

According to Schroders Institutional Investor study, 59 percent of investors view greenwashing as their top challenge when selecting sustainable investments. Identifying greenwashing is becoming more difficult as ESG investments become mainstream for portfolio companies and investors. There are many investment products labeled as sustainable, and there is no way of telling which are genuinely sustainable and which aren't. According to Bloomberg Intelligence, ESG assets may hit $53 trillion by 2025.

Source: Bloomberg Intelligence

Another reason why greenwashing is so easy is due to the lack of regulations around ESG reporting. Currently, there are no set rules around ESG and sustainability initiatives, which makes it easier for companies to give a false impression and provide misleading information about their products and services.

To prevent greenwashing, the European Union set a foundation with the Sustainable Finance Disclosure Regulation (SFDR) to establish a framework to facilitate sustainable investments. In light of the EU Green Deal and to further sustainable finance initiatives, the EU created a taxonomy for sustainable activities which defines what can and cannot be classified as sustainable. As the first of its kind in the ESG investing world, the EU SFDR sets the foundation for other countries in mandating ESG regulations; however, it does not directly apply to the U.S. financial market.

Since the U.S. does not currently have regulations around ESG reporting, fund managers and investors must be aware of each company's ESG actions and critically analyze the company's approach to ESG.

Third-party providers

Financial institutions, asset managers, and other stakeholders measure a company's ESG performance through third-party data providers and rating agencies. Third-party data providers such as Morningstar, Nasdaq, and FactSet provide reports and ratings on international and domestic public and private companies on their ESG performance compared with peers. '

Although ESG ratings can help identify companies with favorable ESG practices, they can also contribute to greenwashing. The report and ratings from providers can vary depending on each provider's methodology towards rating ESGs. Rating providers also range from independent firms like Sustainalytics to larger index providers like Bloomberg ESG Data Services, S&P Global, FTSE Russell, etc. Therefore, financial advisors and investors need to compare the reports and ratings of various providers.

Analyzing historical data

It is easy for third-party providers and investment firms to find "green" stocks and bonds and achieve high ratings, but that still does not accurately represent a company's ESG performance. It is far more challenging to dig down into what matters and requires data analysis over some time.

Another way to understand a company's ESG practices is by analyzing historical data. Historical data shows how a company has practiced sustainability initiatives across the past several years, which can provide insight into how a company views sustainability, how long it has practiced sustainability, and whether its other actions align with its marketing campaigns.

Combining historical data with ratings can serve as a powerful strategy for investors to understand a company's ESG actions. If the historical data matches with the ratings, that's a strong indicator that a company is honest about its ESG and sustainability initiatives. Additionally, if a company is transparent about and has a strategy for delivering future earnings and cash flows, they are good indicators that it isn't trying to greenwash.

Due diligence

Investors and financial advisors can navigate against the risks associated with greenwashing by analyzing data and performing due diligence. They can do this by researching and evaluating the information companies provide on ESG-labeled products and services. Additionally, since there are no standardized reporting requirements, investors and advisors can understand an organization's ESG practices by seeing if the company uses a standardized framework to measure ESG performance and impact.

Organizations that provide an ESG framework include:

- The Un Sustainable Development Goals (SDGs) provide a defined framework for companies to follow with 17 SDGs and 169 associated targets on tackling poverty and ensuring more equality, environmental sustainability, and economic development.

- The Global Reporting Initiative is a global independent organization that helps governments and businesses understand the environmental, social, and governance issues and tackle them. The GRI Standards provide transparency on the impact of companies on sustainability issues.

- The World Benchmarking Alliance measures the impact of businesses using the SDGs.

- The Sustainability Accounting Standards Board (SASB) helps businesses identify, manage, and report on sustainability topics. It also allows investors determine the ESG issues that are most relevant to financial performance.

These organizations are committed to helping businesses, governments, and other organizations understand and communicate their impact on environmental, social, and governance issues such as climate change, human rights, and corruption.

Tools to track ESG initiatives

Identifying companies that are true to their ESG initiatives is challenging, primarily because of the lack of regulations around ESG ratings, the number of companies labeling their services and goods as sustainable, and greenwashing. Although third-party providers are an option, it's hard to tell which third-party provider has the most accurate ESG ratings. Additionally, investors and financial advisors can spend hours digging through and analyzing historical data and still not accurately interpreting all available information.

Using third-party providers and comparing their findings against your research and due diligence is the best way to mitigate risk and avoid investing in companies that have "greenwashed" their ESG activities. Fortunately, tools like artificial intelligence exist to enable financial advisors and investors to quickly research, extract, and analyze millions of unstructured data sets to identify where a company stands on issues like climate change, human rights, and corruption.

For more information on filling in the gaps of ESG data for investing, register for our upcoming webinar: It Ain't Easy Tracking Green: How to Fill in the Gaps of ESG Data for Investing

About Accern

Accern is a no-code AI platform that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com