How Does ESG Investing Work?

ESG investing, also known as sustainable investing, is a strategy that investors use to invest in companies that score highly on environmental, social, and governance responsibility scales. These scores are determined by an internal company framework, third-party companies, research groups, and data providers. So how does ESG investing work?

What does ESG stand for?

ESG is an acronym that stands for Environment, Social and Governance. Investors are increasingly interested in these three factors as they can give a well-rounded perspective about a company's long term potential. For example, ESGs can tell whether a company is providing positive impact to society and the environment by how the company treats their shareholders, if they're making their products with sustainable materials, how they're addressing issues like climate change, gender pay gap, diversity and inclusion, and more. Investors who are interested in ESG investments will want to know:

- What is the company's stance on social issues?

- How does the company treat its employees?

- How diverse is the company's workforce?

- What impact does the company have on nature and environment?

- Is the company run ethically?

Investors now want to reward companies that value social and environmental impact and long-term gains over near-term profit at all costs. Research has shown a correlation between companies with strong ESG practices and volatility. Companies that can prove strong ESG mandates are less volatile and provide higher, long-term gains. In a study done by Deutsche Bank's Asset and Wealth Management division, there was a 62.5% positive correlation between ESG and corporate financial performance, while only 10% of results were negative.

What are the criteria for ESGs?

The ESG criteria are a framework to help investors identify companies with social and environmental values that match their own and to incorporate these companies into their investment portfolios. The screening process includes identifying companies that have built strong social responsibility tactics, sound environmental practices, and ethical governance initiatives into their everyday operations and corporate policies.

-

Environment. A company's impact on nature and the environment and its ability to contribute positively to the environment while mitigating risks that could harm it. This can include a company's carbon footprint, energy efficiency, conservation of water and other natural resources, treatment of animals, and waste management. It can also include whether the company uses toxic chemicals in its manufacturing processes and supply chain.

Research has shown that companies that practice sustainability and "go green" can actually reduce operational costs. For example. according to a study by Energysage, commercial properties can reduce their electricity bill by 75 percent by installing solar panels.

-

Social. A company's impact on society within its organization and broader community resonates with large groups of people. There are various causes that make up social impact, but they all seek to improve the quality of life. Social factors include LGBTQ+ equality, racial diversity in the staff and within the executive suite, inclusion programs, hiring practices, company culture, and even how a company treats its customers, suppliers, employees, and the local community. Additionally, it looks at how a company promotes and supports social good beyond its sphere of business.

Since there are no laws forcing companies to disclose social impact performance, how can investors interested in ESG find out whether a company is really socially responsible? The Global Reporting Initiative and Principles for Responsible Investment provide a respected framework to evaluate whether companies have strong social mandates. ESG investors often look to sustainability reports by the GRI and PRI as both go beyond how a company addresses environmental issues to include information related to employees, suppliers, and the community.

Another way to identify which companies have good social standings is to keep up with respected lists and rankings by respected publications including Fortune's 100 Best Companies to Work For and Forbes' Just 100 Companies Leading the New Era of Responsible Capitalism. Media reports on companies' lobbying efforts related to social justice issues as well as how companies treat their employees are also relevant. Lastly, site likes Glassdoor provide first-hand insight into how a company and its management is viewed by its potential, current, and former employees.

A few things to look for to determine a company's social standings include:- Employee turnover/churn and employee engagement

- Past performance on consumer protection such as lawsuits, product recalls, and regulatory penalties

- Employee training and development

- Friendly and responsive customer service

- Diversity and inclusion in hiring and in promotions

- Ethical supply chain sourcing

- Public stance on social justice issue

-

Governance. How a company is managed by top executives and board of directors, including how they respond to the interests of the company's various stakeholders. Governance includes issues surrounding executive pay to diversity in leadership and how well that leadership responds and interacts with shareholders, employees, and customers. Many ESG investors consider executive compensation as a primary focus- whether executives favor multi-million-dollar bonuses while imposing a salary freeze in effect for other employees, etc. A company with good corporate governance is backed by a strong board of directors that relates well to various stakeholders. IT runs its business effectively and the management aligns team's incentives with the company's success.

A good corporate governance consists of honest financial reporting and financial and accounting transparency, avoiding conflicts of interests, diverse board members and executives, and an inclusive work culture. Details can be found in sustainability reports by the GRI and PRI, but investors should also read annual proxy statements from the companies in which they own shares. Additionally, the SEC offers proxy statements, in which investors can search for filing type DEF 14S (definitive proxy statement), which is required under Section 14(a) of the Securities Exchange Act of 1934. This statements helps shareholders understand corporate governance practices.

To determine a company's governance initiatives, a few things to look for include:- Top executives' compensation and bonuses.

- A diverse board of directors and executive management

- Potential for conflicts of interest for board members

- If a company's chairman and CEO roles are separate

- Transparency with shareholders and relationship between shareholders

- Relationship with U.S. Securities and Exchange Commission (SEC) and other regulatory bodies.

According to a study by S&P Global, companies that rank below average on ESG factors are prone to mismanagement, risk, and less opportunity to capitalize on business in the long-term. The criteria for ESG investing goes well beyond the three-letter acronym. Environmental, Social and Governance actions are evaluated to analyze how a company serves all its stakeholders including but not limited to employees, customers, shareholders, communities, and the environment.

How Are ESG Scores Calculated?

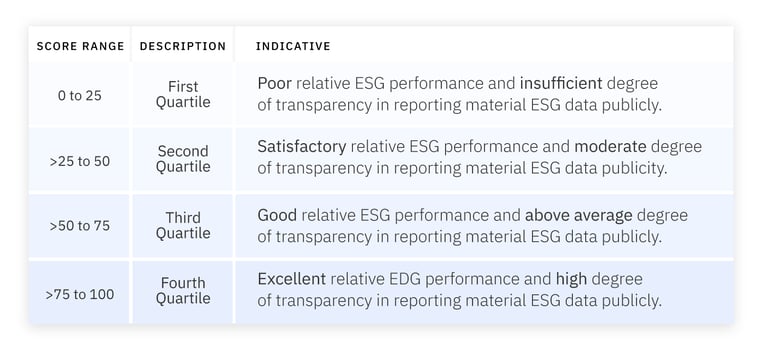

Most global and local public (and many private) companies are evaluated and rated based on their ESG performance. Various third party data providers report and rate on a company's ESG scores. Asset managers, institutional investors, financial firms, and other stakeholders are increasingly interested in these ESG reports to measure and evaluate a company's ESG performance over time and in relation to their peers. ESG scores normally follow a 100-point scale and a company is assessed based on which quartile it falls into relative to a peer group. For example, Refinitiv, a leading ESG research company and data provider divides it scores into four quartiles, as shown in the image below.

Source: Refinitiv

There are multiple ESG research firms that provide scores for a wide range of companies. These research firms also provide a clear metric for comparing different investments. However, the methods for reporting and ratings, coverage, and scope vary depending on the provider. Each ratings firm usually relies on multiple criteria and data source and evaluate each of the company's environment, social, and governance components. A few of the most well-regarded ESG research companies include S&P, Sustainalytics, MSCI, Refinitiv, and Bloomberg.

While each firm that rates ESG assesses specific factors unique to the company and industry it is rating, they commonly review data from corporate sustainability measures, annual reports, resource management, employee engagement, financial management, board structure, executive compensation, supply chain issues, waste management, controversial weapons screenings, and more. The various data sources that research firms must extract insights from can be time consuming as data can come in the form of structured and unstructured text. Therefore, there are several obstacles that ESG research firms face in obtaining accurate and real-time ESG scores to assess a company's ESG performance.

Challenges in determining a company's ESG performance

With the rise in unstructured data projected to grow at 55-65 percent each year, analysts and investors will continue to face challenges in researching large sets of data sets and extracting relevant information to obtain accurate ESG insights. However there is a solution to this unstructured data problem. Investor calls, corporate filings, surveys, and annual reports may provide some insight into ESGs, but these are often not enough to get a complete view of a company's ESG practices. The main challenges of calculating accurate ESG scores include:

- Lack of real-time data- Data is constantly generated with every company tweet, news headline, announcement, and even reviews from stakeholders. The frequency of data generated often makes it hard for investors and analysts to keep up with the latest news on a company's ESG practices.

- Lack of transparency- Two decades ago when the Global Reporting Initiative launched its ESG guidelines, only a handful of companies disclosed their environmental performance. Although the world's largest corporations by revenue are leading the way in reporting ESG data, there are still many companies that have not detailed ESG practices in formal filings. This lack of transparency makes it difficult to calculate accurate ESG scores.

- Ability to miss critical details- With the volume of data and the speed at which new data is constantly generated, important details critical to investment decisions can be missed.

- Limited coverage of ESG factors- There are several ESG factors that are listed under each environment, social, and governance criteria. A well-rounded view on a company's ESG practices includes multiple ESG factors and take into account recent events around a company's ESG impact.

Using AI and NLP for ESG Investments

If an investor only relied on earnings calls, financial results, diversity and inclusion reports, and annual reports, a volume of useful information would be missed. AI can reveal hidden information to bring investors more insights into a company's ESG practices. Analysts can also monitor the ESG practices of more companies in real-time, find hidden but useful information, and share the insights gained from the information. AI can also help analyze the data pulled by attaching a sentiment score to the content, so that investors will know what to do with the information that is found.

Whether tracking how companies perform long-term or looking at short-term controversies, alternative data is critical in calculating ESG scores and informing ESG-driven investment decisions. AI and NLP can be used to gather useful information on companies with strong sustainability, diversity, inclusion and ethical practices at scale. The components of a strong NLP model include content, taxonomy, and analytics.

- Content- A large volume and diverse set of global content such as news, corporate filings, transcripts, investor reports, press releases, trade journals, social media posts, and the like must be analyzed to get a well-rounded view on a company's ESG practices.

- Taxonomy- A variety of taxonomies to apply to the NLP model provides analysts with more options and a broader range of content to cover. Taxonomies include companies and ESG events/factors. For example, a taxonomy could be the company Apple and/or the ESG event "diversity."

- Analytics- Lastly, the content needs to be analyzed. Analytics can tie back identified topics to specific companies and identify sentiment and quantify the relevance and impact. Analytics include entity and event extraction, sentiment analysis on the information, document classification, and relevance analysis.

Calculating ESG Performance with Accern

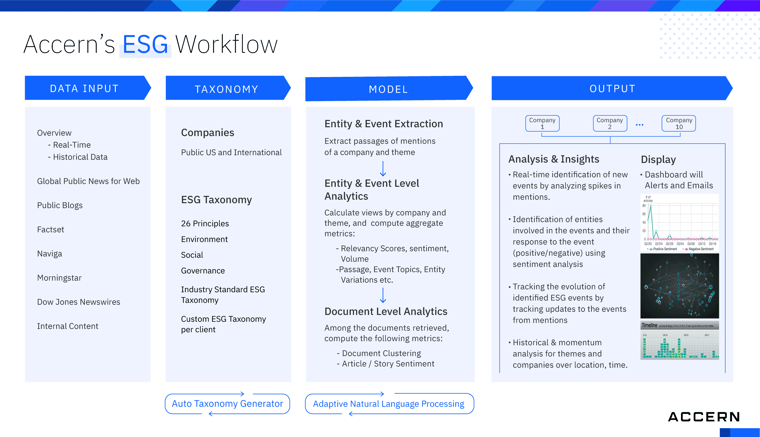

Accern provides a no-code AI platform to calculate ESG performance from the convenience of one platform. With an integrated data store that provides over tens of thousands of sources from global news and public data and content from leading data providers including FactSet, Morningstar, Dow Jones, Naviga, and more, users can build ESG AI models with historical and real-time information.

With data on thousands of public and private companies and over 26 ESG events that come out-of-box including but not limited to fuel management, supply chain, employee health, safety, and wellbeing, labor relations, social impact, and business ethics, investors and financial firms can identify a company's ESG practices by calculating accurate ESG scores. If users would like to expand on the ESG events, they can do so using Accern's no-code machine learning component where additional assets and ESG topics can be added through adaptive learning.

While there are multiple ESG research rating firms, each company assesses specific factors unique to the company and industry it is rating. ESG scores are usually calculated with data from corporate sustainability measures, annual reports, resource management, employee engagement, financial management, board structure, executive compensation, and supply chain and waste management issues. However, due to the volume, variety, and speed at which data is generated, there are several obstacles that ESG research firms face in obtaining accurate ESG scores such as lack of real-time data, lack of transparency, and limited coverage of ESG factors. Accern's No-Code AI platform provides data on thousands of companies, coverage on over 26 ESG events, and out-of-box and customizable ESG AI models.

For more information on ESG investing, and a quick guide, download our ESG cheat sheet.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com