How Artificial Intelligence is Used in Wealth Management

AI in Structuring Unstructured Data

5 Ways AI is Used in Wealth Management

- Providing Client-Centered, Financial Guidance- A client-centered approach can be used to give clients the personalized financial guidance expected from wealth advisors. Smart search capabilities and intelligent tagging allow wealth managers to stay up-to-date on their clients and quickly surface relevant information about each client using advanced AI search capabilities. Intelligent tagging can also help wealth advisors stay up-to-date on client preferences by tagging internal documents and client meeting notes imported from their own CRM systems.

- Portfolio Management- New investment opportunities and risks are identified by constructing AI-generated screening factors on companies’ exposures to ongoing and macroeconomic events. With NLP, advisors can search for various events pertaining to client preferences, goals, and needs. Examples of the events that NLP can search for are natural disasters, trade wars, and interest rates, and investment mandates on ESG, credit, macroeconomic, and M&A transactions.

- Investment Research- Time spent on company research and competitive intelligence can be reduced by eliminating noise and expanding wealth advisors’ insights on data. NLP models can be used to classify document types, specific products, services, and companies or people, identify events, and analyze the sentiment and relevance of a document. These insights can be used to uncover hidden information connected to a client’s primary assets.

- Portfolio Surveillance and Alerts- Alerts on specific companies and events can be generated in real-time with automation, allowing wealth managers to consistently be aware of each client’s portfolio companies. Automated and AI-generated insights allow wealth advisors to stay up-to-date on different companies for each client and act quickly on investment decisions. As a result, wealth advisors will be informed and empowered to provide the best, personalized guidance at the right time.

- Risk Management- Early warning signals and emerging controversies can be uncovered by scanning through unstructured data sets to identify and quantify risks. Using NLP, wealth managers can accurately identify the supply chain, reputation, credit, operation, and market risks of investments to advise clients with the best, personalized financial recommendations.

A No-Code AI Solution for Wealth Managers

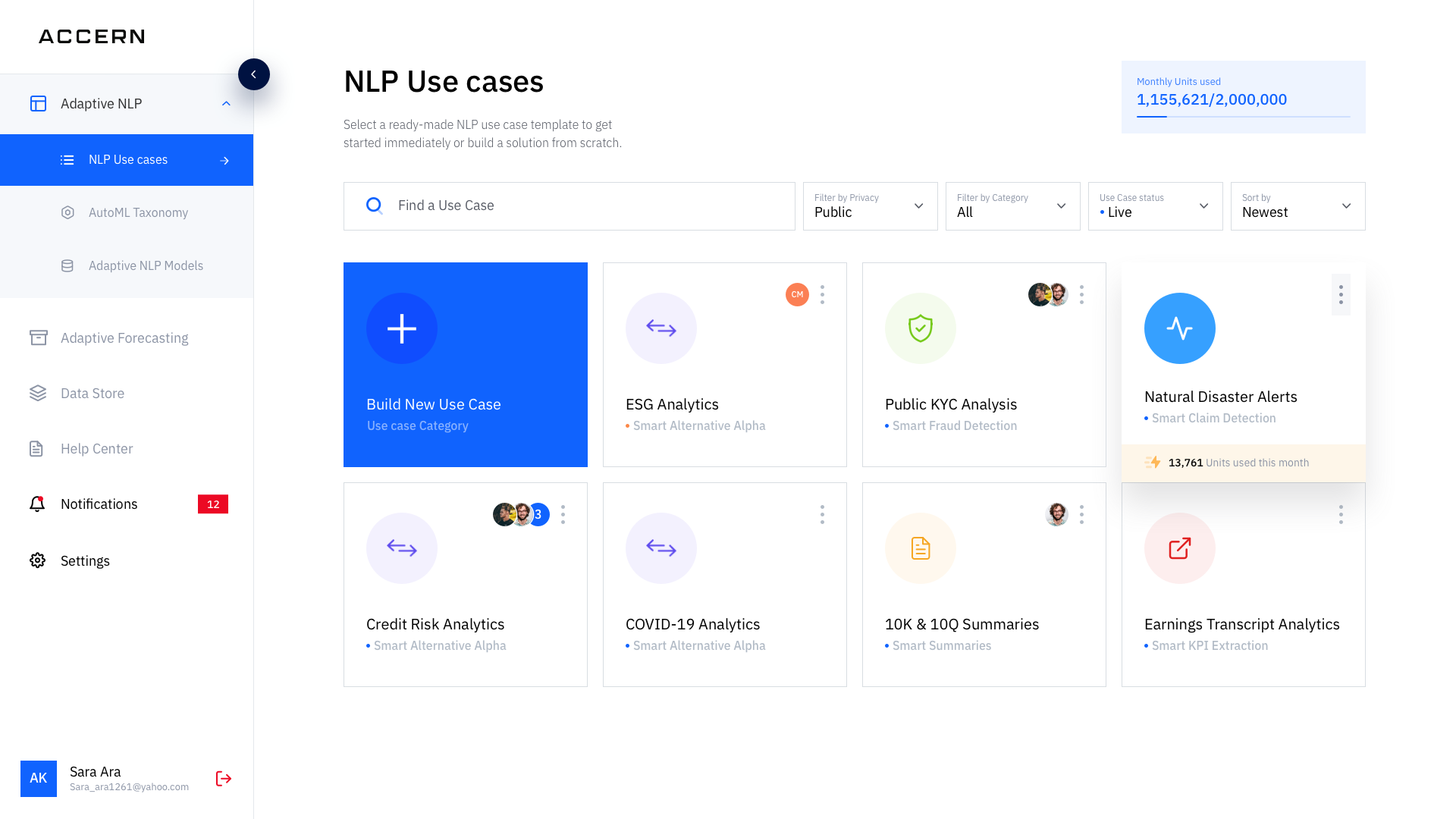

With the advancement of AI and ML tools, we were able to develop a no-code AI platform at Accern, enabling financial analysts and data scientists and engineers to use artificial intelligence without having to code. Wealth management firms can now implement AI and ML easily and quickly to enhance efficiency and productivity across the wealth management value chain.

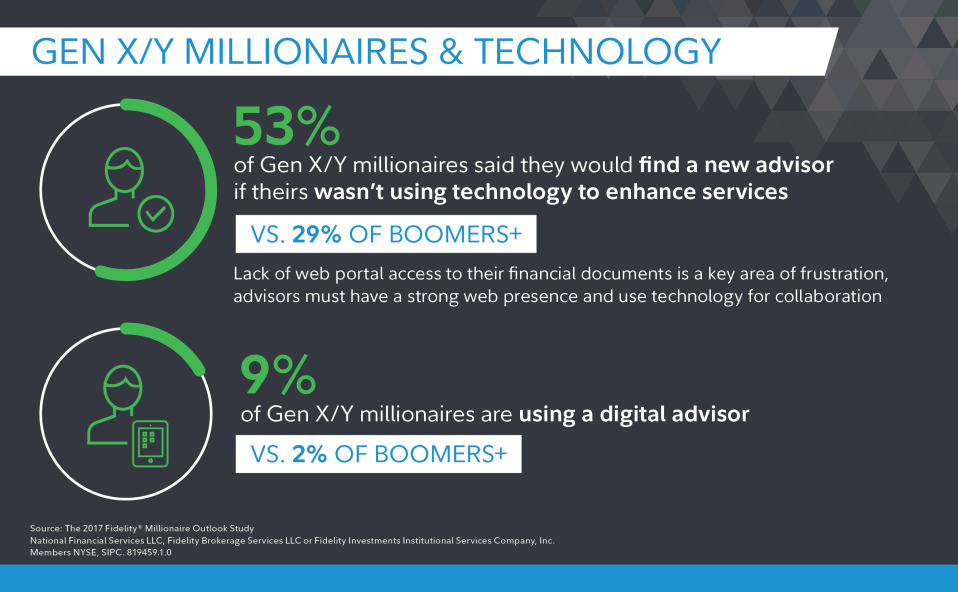

With the technological advancements, the pressure for financial services teams to provide more personalized services is increasing. Wealth management firms that can adopt new technologies to provide personalization will gain a competitive advantage. Wealth management firms can use AI and NLP to provide personalized financial services, aid in portfolio construction and investment research, receive alerts in real-time, and manage risk.

Researchers and data scientists and engineers within wealth management firms can deploy ready-made NLP use cases and build custom NLP models. With its focus on empowering and easing workflows for data scientists and engineers and financial analysts, Accern's platform can be used to structure unstructured data, analyze the sentiment and relevance of data, identify specific data points, and summarize large amounts of text with accurate next steps.

Integrated Data Store

Wealth managers find Accern's platform helpful as they can access the integrated data store to research investment opportunities related to client preferences. The data store provides global news, financial reports, social media posts, and more.

Integration Options

Wealth managers can import files into the Accern platform from PDF, Excel, PowerPoint, CRM systems, and their internal database. Accern's No-Code AI platform can then structure any unstructured data and help wealth managers stay on top of client interactions, be well informed, and provide personalized recommendations.

Adaptive NLP Models

Wealth managers and advisors can also automate many of the manual processes with Accern's retrainable adaptive NLP models. Although Accern offers ready-made NLP models that have been built specifically to provide wealth management solutions, we understand that each firm is different. Therefore, our NLP models can be trained custom to each wealth management firm's policy and pricing guidelines.

Data Visualization

Once AI models are deployed and the data is analyzed, underwriters can view detailed and visual reports through a business intelligence (BI) tool like Kibana. The Kibana dashboard enables you to build your own visualization through charts, plots, and graphs on top of large amounts of data in a story form.

One of the ways in which wealth management firms have found artificial intelligence useful, is by integrating AI tools and software with wealth managers' CRM systems. This enables wealth managers to keep track of, analyze, and form predictions based on client notes, emails, meetings, and more. Accern enables wealth management teams to upload data from their own CRM system, excel spreadsheet, Word doc, PowerPoint, and PDF to build NLP use cases. Visit The Benefit of Integrating Artificial Intelligence in CRM Systems to learn more about why financial firms are integrating AI with their CRM systems.

The adoption of AI within the wealth management industry is growing but there is still much work to be done before we can say most firms have implemented artificial intelligence. The time consumption, cost factors, and expertise needed in creating and training AI models are obstacles to AI adoption. However, with no-code AI, we are one step closer to enabling financial services enterprises to adopt artificial intelligence quicker. To find out if no-code AI is a good fit for your firm, request a demo today.

About Accern

Accern enhances artificial intelligence (AI) workflows for financial services enterprises with a no-code AI platform. Researchers, business analysts, data science teams, and developers use Accern to build and deploy AI use cases powered by adaptive natural language processing (NLP) and forecasting features. The results are that companies cut costs, generate better risk and investment insights, and experience a 24x productivity gain with our smart insights. Allianz, IBM, and Jefferies are utilizing Accern to accelerate innovation. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com