How does the EU Sustainable Finance Disclosure Regulation Impact Investors?

Environmental, Social, and Governance (ESG) factors have become competitive differentiators for both businesses and investors, especially in recent years. However, tracking corporations are following through on their ESG commitments has been a challenge for investors and financial advisors. In order to ensure ESG compliance and regulations, the EU implemented the Sustainable Finance Disclosure Regulation (SFDR). This article will cover how the EU SFDR impacts investors and financial advisors.

Through digital innovation, data is increasing at an exponential rate from social media posts, blogs, web content, online brochures, and other channels. Although digital innovation has made it easier for corporations to interact with their audience and investors, one of the challenges it has led to for investors and consumers is in identifying whether corporations are actually staying true to their corporate statements. This has especially risen when it comes to identifying a corporation's ESG disclosures. Investors are curious to know which corporations are acting in sustainable ways and how their initiatives are lining up to make the world a better place. Up until recently, ESG regulations were non existent, creating a barrier between financial participants and corporations.

What is the SFDR?

The demands for ESGs, sustainable investing, and corporate social responsibility, have risen by investors and consumers. This shift and the lack of regulations around ESGs has made it easier for companies to give a false impression of their products and services and provide misleading information about the ethics of their services or products. To prevent this greenwashing, the European Union's Sustainable Finance Disclosure Regulation (SFDR) went into effect in March, 2021 to establish a framework to facilitate sustainable investment.

The European Commission initiated the SFDR in light of the EU Green Deal and its action plan towards furthering sustainable finance. The SFDR aims to create a stable, sustainable, and transparent financial system that promotes sustainability in capital flows and fosters transparency and long-term strategies into finance and economics. As a result of the SFDR, ESG disclosure obligations are mandatory and financial market participants and financial advisers are required to transparently report on their ESG initiatives on both product and entity levels.

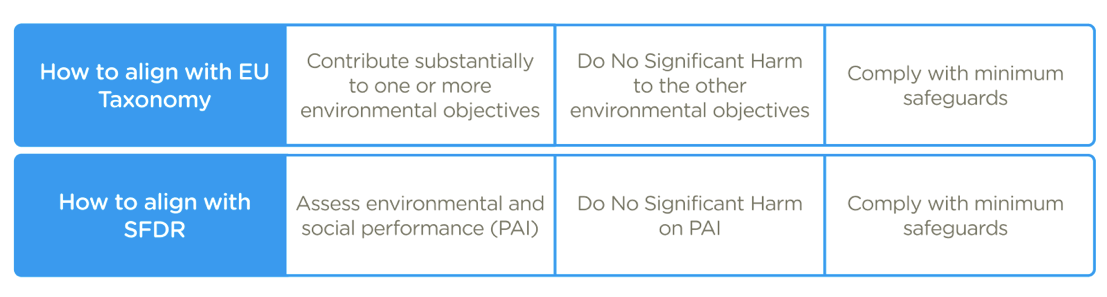

To hold corporations accountable, the EU passed the Taxonomy Regulation which is a key piece of legislation from the SFDR. The EU taxonomy is a green classification system that defines the EU's sustainability objectives into specific criteria for investment purposes. The EU Taxonomy Regulation requires mandatory disclosure of Taxonomy-aligned activities through the taxonomy classification tool. The classification tool recognizes green or "environmentally sustainable," economic activities that impact any of the EU's sustainability objectives.

Together, the SFDR and the Taxonomy Regulation ensures that corporations are actually following through on their ESG commitments. Disclosure on Taxonomy- aligned activities enable investors and financial advisors to compare companies and investment portfolios. Additionally, ensuring regulations and compliance enables ESGs to be a regular part of investment and financial capital market workflows.

Source: Ramboll

Who is the SFDR for?

Both the SFDR and the Taxonomy Regulation apply to a broad audience spanning the entire asset management industry and any other financial participants that conduct business in or with the EU. Furthermore, the Taxonomy Regulation applies directly to Member States, who are prohibited from introducing their own rules that could compromise the integrity of the Taxonomy.

The SFDR applies broadly to all asset managers and financial advisors who conduct business in Europe. Non European asset managers and financial advisors and their subsidiaries who conduct business in Europe or sell products to the EU must also follow the SFDR. Lastly, non-EU firms that assist EU funds or assets are also required to disclose ESG information.

All asset managers and financial advisors that the SFDR applies to are required to publish information on their sustainability/ESG processes on their websites, in promotional materials, in periodic reports, and in any pre-contractual documentation. Financial products must be divided into three categories (dark green, light green, and non-sustainable) depending on their ESG impact. Lastly, they must report on any considerations of negative sustainability impacts if asked, to ensure that it follows the "do no significant harm" principle of the SFDR.

What the SFDR means for ESG

ESG (Environmental, Social, Governance) investing is one of the fastest-growing investment strategies around the world. Global challenges from climate change, social unrest, and a global pandemic has shed light on the importance of corporate social responsibility and sustainability. As a result, investors, financial institutions, corporations, and consumers around the world have increased their commitment to ESGs.

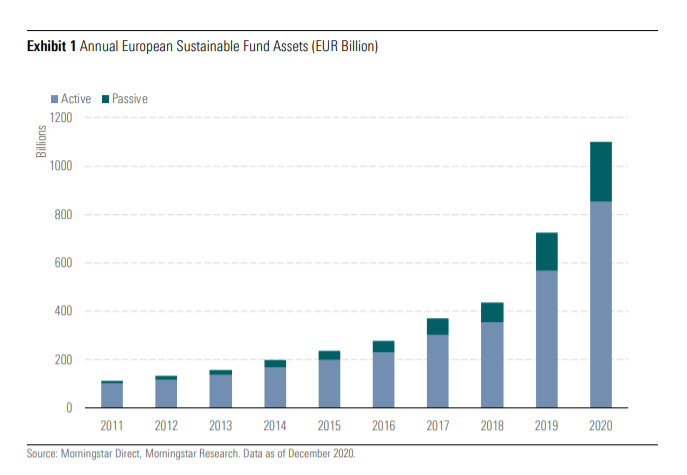

According to Morningstar, assets in EU sustainable funds hit 1.1 trillion Euros by December 2020, marking a 55 percent rise compared to the previous year. Additionally, in the U.S., flows into sustainable funds were almost double the pace in 2019. Fortune states that the demand in ESG was not just a European trend, as new ESG-branded ETFs and open-ended funds in the U.S. also rose by a third in 2020 compared to the year before.

The EU tightened their ESG regulations with the SFDR and Taxonomy Regulation to shift capital towards a more sustainable economy. With the development of the SFDR, the European Commission created standards for ESG terminology, reporting, and disclosures to enforce sustainable requirements. Although the SFDR only applies to EU companies, the new regulations and shift in the financial industry can impact U.S. markets as well, and set the standard for the future.

Lack of ESG regulations have been a challenge worldwide. The SFDR is a step towards regulating ESG standards set forth by the European Commission but its potential impact extends worldwide towards sustainable investing. These new regulations may help standardize ESG terminology and reporting requirements around the world.

Under the SFDR and Taxonomy Regulations, investment firms are required to disclose:

- The environmental sustainability of an investment and the accuracy of any ESG claims made;

- The risks investments present to ESG factors;

- The risks ESG factors present to investments.

The SFDR rules are broken down into mandatory and "comply or explain" rules and are separated between entity and product-level rules.

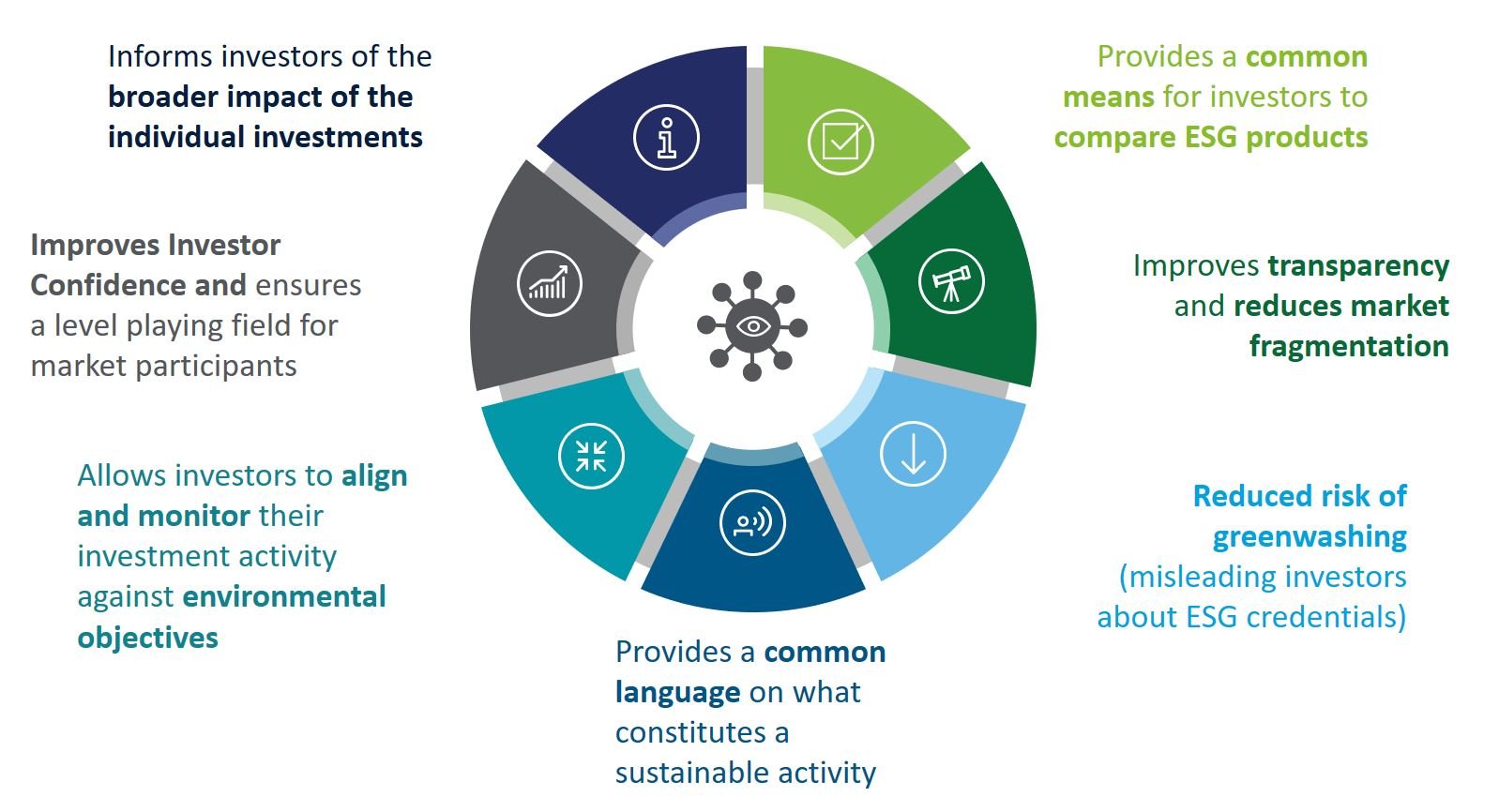

As investors inquire more regularly about how corporations are combatting climate change, how employees and service providers are being treated, their commitment to sustainability initiatives, and other ESG activities, the SFDR improves the chances for investors to identify the right companies acting in line with their values. Investors will also have more control over investments and a better understanding of the impact their investments have. The SFDRs not only provide greater transparency to investors, but to consumers and clients as well, ultimately transforming the financial industries and the way corporations do business.

The goal of the SFDR

The goals of the SFDR are to ensure that European investors have accurate and transparent reporting to make investment decisions that are in line with their own social impact goals. With more transparency on sustainability from corporations, the SFDR hopes to eliminate greenwashing or false or misleading ESG information from companies' marketing or advertising practices on their products and services. This will hold companies accountable and enable more transparency with ESG disclosures.

To achieve this, the SFDR requires that all sustainable and non-sustainable funds disclose ESG practices to potential investors. This encourages firms to improve the sustainability of their business operations in order to comply with the mandatory disclosure requirements and remain competitive in an increasingly ESG-focused market. With greater corporate transparency, investors will be able to make better informed investment decisions and there will be more of a measurable impact on the growth of a sustainable economy.

Source: Deloitte

How does the SFDR impact U.S. financial markets?

Although the SFDR does not apply directly to the U.S. financial market, there are instances in which investors and financial advisors will need to comply with the EU's SFDR. Those who will need to comply with the EU's regulations include the following participants:

- all EU based and non-EU based asset managers that raise money in the EU

- any investment manager or advisor based outside of the EU who market or plan to market products or services to EU clients.

- Any US-based firm that also offers funds in Europe.

The impact of SFDR on investors

The SFDR applies to all portfolio and fund managers, financial advisors, and pension providers who participate in EU financial markets in any capacity. However, the SFDR impacts everyone differently depending on their role and how they're contributing to capital flowing within the EU. A few ways that the SFDR will impact investors include:

- Asset managers must disclose their ESG policies at both the firm and product level. They must also be transparent about what they consider are negative effects that an investment decision or advice might have on sustainability factors (also known as Principle Adverse Impacts (PAIs)).

- Larger firms will be required to report on how they consider PAIs.

- Financial advisors must explain to their clients how they determine the sustainability factors on investment returns.

Although the SFDR and Taxonomy Regulation adds a complicated step towards ESG investments, the new regulations benefit investors, corporations, consumers, and the financial market as a whole. Prior to the SFDR, there were no regulations around ESG investing. Investors did not have the full picture around their sustainable investments and a corporation's sustainability initiatives. The regulations set the standard for transparent and accurate reporting on ESGs so that investors can have a better idea of their sustainable investments and whether they want to invest in a certain company or not.

With the amount of digital data and its growth, the SFDR enables investors to have quality data around sustainable initiatives. This information can help measure the impact of their portfolio on returns and sustainable objectives and analyze risks that could pose a threat to their investments. More accurate information around a company's sustainability objectives provides investors with greater knowledge and more control around their portfolios and investments.

Although the SFDR is the first of its kind in the ESG investing world and only applies to financial markets that conduct business with or in the EU, it sets the bar for sustainable investing across the world. With set regulations for ESG investing and technological innovations in the field of artificial intelligence and machine learning, investors have more control over their investments. For information about ESG investing and how AI can help, download Accern's ESG investing cheat sheet.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com