Artificial Intelligence for Banking: How is it used?

Financial institutions such as commercial and investment banks, credit card companies, credit rating agencies, and investment firms rely on various data sources to determine the risk of lending to a potential borrower. However, with the increase in digital and unstructured data, the banking industry faces obstacles in monitoring a potential individual or corporate borrower's financials in real-time. So, let's take a look at artificial intelligence for banking and how it improves time-consuming processes.

The Unstructured Data Challenge in Banking

Traditionally, financial institutions such as commercial and investment banks, credit card institutions, credit rating agencies, and investment firms have relied on analysts and data scientists to perform manual processes to obtain the right insights at the right time. Credit analysts may actively monitor the credibility of securities, companies, or individuals to determine the likelihood that a borrower can repay their financial obligations. Analysts will review the borrower's credit and financial history to determine whether the subject's financial health and economic outlook are positive.

For example, an analyst at a bank may examine a restaurant's financial statements and credit history to identify its cash flows and ability to pay on time before approving a loan for new kitchen equipment.

When analyzing the potential borrower's behavior and credit history, analysts will interpret financial statements to determine whether the borrower has an abundant cash flow and good credit standings. This is called early mitigation as analysts try to identify early warning signals of any signs of deteriorating credit.

For example, if a business client is struggling to pay its bills on time, this could be an indicator of declining revenue and future bankruptcy, which may affect the bank’s assets, ratings, and reputation.

Credit analysts can also run a simulation to understand the potential impact a change in credit can have on the borrower. Economic changes caused by the environment, stock market volatility, legislative changes, and regulatory requirements are a few of the risk factors that analysts will keep in mind. After considering risk factors, analysts may recommend specific courses of action for the borrower to take such as suggesting a business loan or business credit card.

Obtaining clean data is a critical part of determining the level of risk involved in lending to a potential borrower. If the bank proceeds with the loan approval, the credit analyst will continue to monitor the borrower's performance to ensure that banks have the correct information to act fast and mitigate risk. Based on what the analyst interprets, he or she may issue recommendations such as reducing the loan or credit limit, switching to a new credit card, or even terminating the loan agreement. Determining the level of risk on a loan, credit card, or investment helps banks manage risk.

Data Analytics in Banking

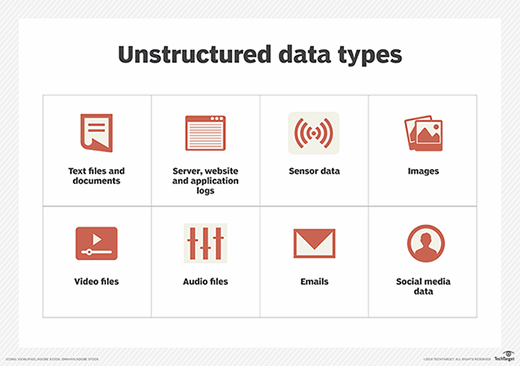

Rich insights can be drawn from digital content but the IDC estimates that 90 percent of all digital data is unstructured content. In order to have a holistic understanding of a company’s or individual's background, analysts must build their views from both traditional unstructured sources such as brokerage reports, news and corporate filings, as well as non-traditional sources such as trade journals, social media, blogs, call recordings and earnings/corporate transcripts.

As unstructured data continues to grow at 55-65 percent each year, commercial and investment banks, credit card institutions, credit rating agencies, and investment firms face challenges in sorting through and extracting key insights from the large volume of data and will inevitably have to adopt artificial intelligence into their workflows to navigate around the unprecedented increase in unstructured content.

Source: TechTarget

Source: TechTargetNatural language processing (NLP) is an artificial intelligence (AI) technology that enables computers to understand text and audio data in the same way that humans can- with the human language. By applying NLP techniques to unstructured data, lending institutions, investment banks, and credit agencies can reduce costs in operations across the front, middle, and back offices.

The wealth of information NLP uncovers can offer banks a competitive advantage through insights into customers’ lives, goals, needs, and challenges. A few of the main areas where NLP insights can be applied are:

- Adverse Media Screening: The complexity, sophistication, and scale of financial crimes has rapidly increased over the past decade. Banks and financial institutions use adverse media screening, such as know your client (KYC) checks and anti-money laundering (AML) to enforce anti-crime measures. Banks can manage risk by using AI and NLP to gather data in real-time about a customer or prospect, including any negative information about them. Data analytics can provide information from the open web, deep web, and other premium sources that include structured and unstructured data.

- Credit Lending Processes: Banks can use AI to extract data from borrowers’ behavior online and analyze people’s searches, location and payment data to determine creditworthiness. For example. the market for real estate lending is massive with over 10 million homes and commercial properties selling each year. According to the Fed’s latest report, mortgage debt from homes and businesses tops $15 trillion. Banks can mitigate risk by analyzing the potential borrower's behavior and credit history, analysts will interpret financial statements to determine whether the borrower has an abundant cash flow and good credit standings.

- Insights for Coverage Bankers: Investment banks are realizing the value of AI in providing clients with personalized recommendations and deepening customer relationships. Coverage bankers must know the historical and real-time updates of a specific market industry in order to provide unique investment insights to corporations and governments. Through NLP and automation, AI enables coverage bankers to quickly uncover industry-specific trends, corporate news and events, and identify the best financial deals.

- Risk Management: To manage risk, analysts can evaluate the probability of default (PD) and early warning signals in credit risk. Traditionally, PD and early warning systems require extensive research, analysis, and expert judgment to identify indicators of risk. AI can help analysts identify patterns through large volumes of data at scale. AI algorithms use indicators from a wide range of sources to generate accurate and early warning signals on potential credit migrations, payment supplier risks, negative news on public and private companies, analyst ratings, and more.

The insights gained from NLP allow banks to enhance adverse media screening and credit lending processes, gain insights into deteriorating credit, and manage risk. The benefits of AI and NLP include extracting key insights from industry-specific news sources, automating credit lending processes, and uncovering early warning signals.

Retail, commercial, and investment banks can apply AI across the full value chain in various capacities. While investment banks will find AI especially useful for industry-specific investment insights, retail and commercial banks can enhance credit lending processes and manage risk with early warning signals.

Accern's No-Code AI Solutions for Banks

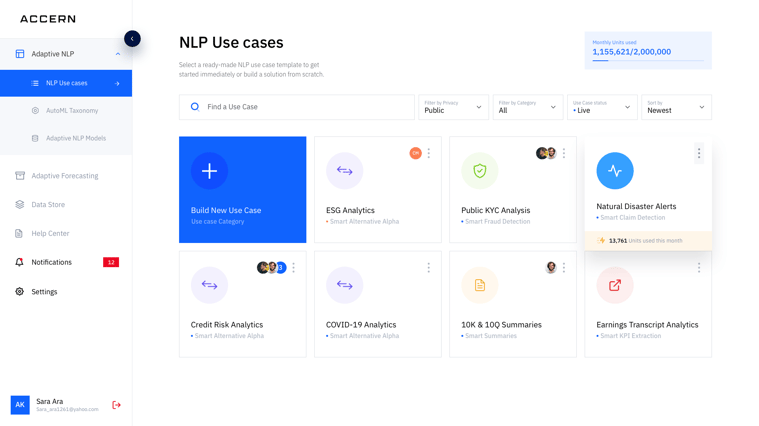

With the advancement of AI and ML tools, Accern's No-Code AI platform enables financial analysts and data scientists and engineers to use artificial intelligence without having to code. Banks can now implement AI and ML easily and quickly to enhance efficiency and productivity across the back, middle, and front office value chain.

Accern's AI-powered credit risk solutions include ready-made use cases that banks can deploy out-of-box. Use cases include AI insights on credit risk, anti-money laundering analytics, customer credit risk analytics, and more. While analysts can use these ready-made AI models immediately, data scientists can use their skills to completely retrain these models to the financial firm's specific needs.

For example, Fundomate, a business funding company was able to use Accern's AI service to fully automate the credit risk process. From data collection to infrastructure and support, Accern supported and helped customize Fundomate's AI process to improve predictions on credit default and manage risk.

Determining a company's credit risk to ensure that the lender provides appropriate business funding is an evolving process. In Fundomate's case, where the company provides alternate funding products to customers, credit risk assessment, continuous updates to its models, and improvements in credit default are necessary to minimize the level of risk from potential credit default. The result was a significant increase in Fundomate's ability to predict risk. To learn more, download the case study.

With technological advancements, the pressure for financial services teams to quickly navigate through unstructured and structured data sources is increasing. Banks that can adopt new technologies, including banking AI, to gain insights into a potential borrower's credit and financial health will gain a competitive advantage by managing the risk of customers defaulting on payments.

Analysts, data scientists, and engineers at commercial and investment banks, credit card institutions, credit rating agencies, and investment firms can deploy Accern's ready-made NLP use cases and build custom NLP models. With its focus on empowering and easing workflows for data scientists and engineers and financial analysts, Accern's platform can be used to structure unstructured data, analyze the sentiment and relevance of data, identify specific data points, and summarize large amounts of text with insights to accurate next steps.

To see Accern's No-Code AI platform in action and learn about the importance of ai for banking in the credit lending and risk management processes, schedule a demo today.