5 Ways Predictive Analytics is Used in Insurance

Predictive analytics has been useful in appraising and controlling risk within the insurance sector. Large insurance companies such as Allianz and others have used the insights from predictive analytics in their underwriting, claims, and marketing operations. Through data mining, predictive modeling, statistics, machine learning, and artificial intelligence (AI), the most common predictive analytics use cases include producing accurate insights that aid in underwriting policies and personalizing client services. Predictive analytics is also being used in other ways within insurance, especially as the tools for accurate analytics are increasing.

According to the Life Predictive Analytics Survey Report, more than 60 percent of insurers credit predictive analytics for helping reduce underwriting expenses. Additionally, another 60 percent stated that the additional insights gained from predictive analytics has increased sales and profitability. Predictive analytics has left a positive impact on business performance and operations, influencing more companies within the insurance industry to adopt it within business practices.

Source: Willis Towers Watson

According to Willis Towers Watson, the third largest insurance broker in the world, who conducted the survey, the numbers are expected to grow significantly over the next few years as predictive analytics is providing more value in multiple applications within insurance firms. One of the greatest values is enabling insurance firms to collect large amounts of data from a variety of internal and external sources to better understand and predict the behaviors of their prospective clients. For example, property and casualty (P&C) companies can collect data from customer interactions, social media, telematics, agent interactions, smart home applications, and more to understand their audience better, manage their client relationships, and assist in underwriting and claims processes.

What is predictive analytics in insurance?

Predictive analytics is the use of various statistical techniques from data mining, predictive modeling, AI, and machine learning to analyze historical and real-time data to make predictions about future events. With the amount of data on the Internet and the massive increase in digital, textual data, insurance firms have relied on predictive analytics to assist in business operations.

Predictive analytics in insurance is about using a variety of methods such as statistics, data mining, predictive modeling, machine learning, and AI to manage risk and assist in the underwriting and policymaking processes. It allows insurers to convert data into actionable insights on customers, agents, and markets, as well as implement factual strategies that drive long-term growth. These insights can empower insurers to understand and identify their greatest market opportunities, create a strategy for sustainable growth, and provide personalization for customers.

Although predictive analytics is not a new concept, insurers have been using the basics of these analytics for decades. For example, in the past insurance brokers may have used predictive analytics to change a premium on a policy, while today brokers can analyze and extract insights from dozens of data to inform pricing decisions and provide personalized policies to clients. Predictive analytics is an innovative approach to the traditional method. By using machine learning, AI, and big data analysis on historical data with predictive analytics, insurers can find patterns in customer behavior to create risk models based on actual events, rather than estimates.

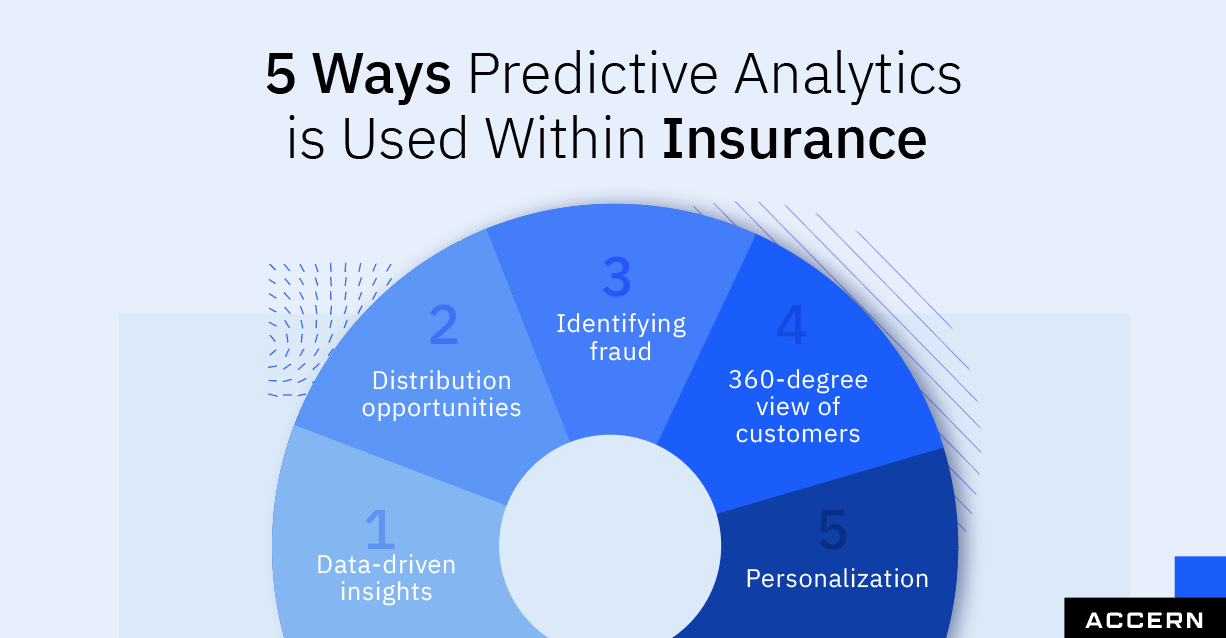

5 Ways Predictive Analytics is Used Within Insurance

Data-Driven Insights

Data is used in nearly every aspect of an insurer's operations. It is one of the most valuable resources that an insurer can have as it gives insights into current and prospective clients. Although having more data is better, the amount of data is a challenge for many insurance firms as the right data points must be identified and extracted to obtain accurate insights. Having an organized data management system not only helps in obtaining accurate insights but makes it easier to use predictive modeling.

If data is unorganized and scattered across various systems, it can be easy for insurers to miss valuable information hidden across various data points. Therefore, finding value from data is only possible through data management and modeling, otherwise the data is wasted. Once data is managed in one system, predictive analytics tools can be used to build and analyze customer profiles accurately, provide insights into marketing opportunities, identify risk, and even predict profit from each customer.

An organized data management system also enables insurers to deliver services to their customers on-demand through a cloud. Predictive analytics can be used to deliver data-driven insights from the insurance firm's data management platforms by extracting relevant information from client interactions, messages, e-mails, and more.

In short, predictive analytics helps insurers make the most of the large amounts data at the hands of insurers. From predicting customer behavior to assisting in the underwriting processes, combining predictive analytics with data helps provide valuable insights to insurers.

Identifying Fraud

A top challenge that insurance firms face is in identifying and preventing fraud. Insurance fraud can come in the form of false or stolen identities to obtain a new policy, false payee information, false application details, and more. Claimants who attempt to commit fraud will do so in an attempt to obtain additional insurance benefits or advantages that they are not entitled to.

While fraud continues to evolve as scammers find new ways, it affects all types of insurance. The industries that are most affected by fraud are in automobile insurance, workers’ compensation, and health insurance. Approximately $80 billion is lost annually from all kinds of insurance fraud in the United States alone, according to the Coalition of Insurance Fraud. Additionally, 5-10 percent of insurance claims costs are made up of fraud in the United States and Canada.

With predictive analytics, insurance firms can identify potential fraud by using data from the claimant's activities. Identifying fraud before it happens makes it much more likely for insurers to prevent potential fraud or pursue corrective measures, saving the firm millions of dollars that can be otherwise lost to fraud. Predictive analytics can even be used on a claimants social media and online activity, to analyze data after a claim is settled for any activity that can reveal red flags. Insurers can also detect fraud by using predictive analytics to identify any mismatches between the claimant and any third parties involved in the claim such as a repair shop, to ensure that payouts for repairs are being used as intended.

Identifying New Opportunities for Distribution

The insurance industry is extremely competitive, and even more so in the post-COVID world. Insurance firms are constantly at risk of losing clients to other firms that may offer better benefits at lower premiums. Identifying potential markets is important to know where to spend on marketing efforts. Insurers can use the data to identify potential customers' behavior patterns and common characteristics and demographics to identify their next market opportunity.

Predictive analytics can transform distribution by providing deeper insights into customers, markets, channels, and marketing campaigns to help insurers plan and execute distribution strategies. By identifying and understanding potential markets better through factual data, insurers can make the most of their resources and drive competitive advantage.

Understanding the 360-Degree View of Customers

Digital transformation offers businesses more opportunities to interact with customers. Customers are more likely than ever to stay loyal to companies that engage with their clients and understand their needs. This is especially seen within the financial services industry, where organizations that can show clients they understand and can meet their needs are selected over those that cannot.

In order to engage with customers, insurers must understand what drives people's behaviors and decision-making processes. With predictive analytics, insurers can analyze data and generate insights to paint a 360-degree view of each customer. This includes insights into a customer's buying habits, interests, needs, risk assessment, and even how likely or able they are to expand or buy a new coverage.

Prior to predictive analytics, insurers would have to manually gather data to make educated guesses on clients. However, with predictive analytics, insurers can now identify a customer's needs accurately and effectively. Insurers can even understand which customers they can profit from the most, which will be most loyal, and which are at risk of cancelling or lowering their coverage, resulting in better-targeted marketing efforts, happier clients, and increased revenues. Additionally, insurers will be able to focus more of their efforts on their most valuable customers.

Providing a Personalized Experience

Personalizing customer interactions builds loyalty as many customers value a customized experience, even when shopping for insurance. Nearly half of customers have left a company for a competitor that better understood and delivered on their needs. Predictive analytics in insurance allows insurers to navigate through all of the digital data to understand their customers' needs and desires. The analytics enables insurers to understand each customer's history, behavior, and interests to anticipate their needs. The data can also be used so that insurers can modify their services or processes based on changes in information.

Predictive analytics can also help insurers segment customers into groups that share similar interests, expectations, and needs. This enables insurers to identify different strategies for each group of customers, specific to their needs. The data and insights gained from predictive analytics is valuable in determining where to spend the most resources and in identifying the best opportunities.

Moving forward, predictive analytics will become more widely used within insurance firms to help forecast events and gain valuable insights into various aspects of the insurance industry. Predictive analytics helps insurers make the most of digital data and save time, money, and resources. It provides a competitive advantage to insurance firms through the insights gained in the market, on customers, and on competitors.

For more information on how AI is used in insurance, check out the Three Ways Artificial Intelligence is Used in Insurance Underwriting.

About Accern

Accern is a no-code AI platform that provides an end-to-end data science process that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com