4 Ways AI is Transforming Financial Services in 2022

The impact of artificial intelligence (AI) is seen across financial services today. AI continues to transform financial services, especially when it comes to data analysis, automation, and personalization. With the market for AI to reach $26.67 billion by 2026, with a compound annual growth rate of 23.17 percent, here are four ways that AI is transforming financial services and what to look out for in 2022 and beyond.

Artificial intelligence (AI) in Financial Services

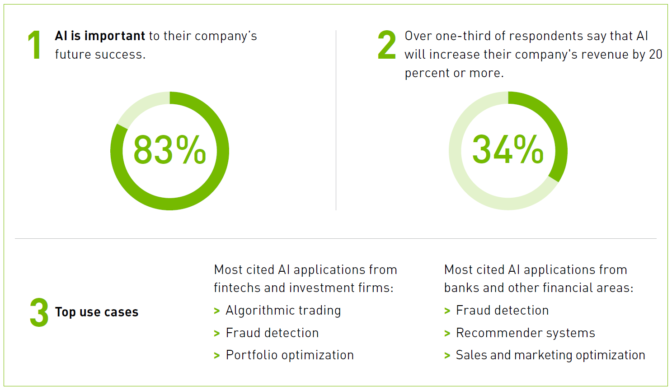

Since the 1980s, AI has benefited the financial services industry, with banks, asset management firms, hedge funds, and insurance companies leading AI adoption. AI continues to transform financial services, with more than 80 percent of executives and professionals stating that it has contributed to their success and will contribute to their company's future success. Furthermore, according to Mckinsey's report, 34 percent of enterprises that use AI reported that AI had increased their company's annual revenue by at least 20 percent.

One of the most significant ways AI has transformed the financial services industry is navigating around massive amounts of data. Data makes up the majority of financial services operations and decision-making procedures. All firms rely on data to make informed decisions. Whether banks are looking to determine credit risk, insurance firms are underwriting policies, or hedge fund managers are looking to generate positive alpha, data is the driving factor in every decision.

The inability to quickly digest data and draw relevant and accurate insights from datasets can negatively impact several business processes within financial services. Fortunately, AI enables financial firms to navigate the massive amounts of data in various ways and use the insights gained from them. AI can help with the operations processes after revealing insights to help finance professionals make the most out of their data and understand what next steps to take. Here's how AI is transforming financial services and what to look out for in 2022.

How AI is Transforming Financial Services

1. Automating manual processes

Until AI became more profound, financial services firms relied on manual-intensive processes to navigate structured and unstructured data. Fundamental and quant analysts would spend days manually researching and analyzing structured and unstructured data sets for the next best investment move. At the same time, insurance underwriters and retail lenders would manually search through financial and tax statements and personal documents to analyze a potential policyholder or borrower's credit risk.

As data expands, it is nearly impossible for financial professionals to continue in manual-intensive processes. Structured data is easier to analyze, but unstructured data makes up most of today's global data (80 percent). Unstructured data has no predefined framework or structure and comes in the form of images, audio and video files, text files, and emails, to name a few. Therefore, it will be highly inefficient and time-consuming if an analyst attempts to gather insights by researching unstructured data.

Financial services firms have found innovative ways to make professionals' lives easier while increasing efficiency and ROI to adapt to the expanding digital world by innovating and enhancing artificial intelligence across more use cases. While AI was primarily used to interpret text with natural language processing (NLP) in the past, today, financial firms are taking it a step further by using AI to automate manual research processes.

Although there are many forms of automation, AI automation is the most complex. It uses AI and machine learning to learn and then make decisions based on past situations they have encountered and analyzed. Financial firms can train AI models to make decisions based on a series of rules. AI models can also be trained to replicate previous analyses on new data sets. Automating decision-making and analysis processes eliminates the need for highly redundant and manually intensive tasks, allowing finance professionals to focus on what matters most.

For example, banks are the leading sector taking advantage of automation's benefits, specifically within the lending process. It has accelerated and improved every stage of the loan process from pre-screening to customer onboarding by screening applicants' information and documents to ensure that they meet the bank's minimum lending requirements.

2. Accelerating Trading with Algorithmic Trading

The increase in digital data has impacted banks, insurance firms, and nearly every sector of the financial services industry, including hedge funds. Stock market data has surged with the emergence of new data types, instruments, and platforms for trading. Traders would typically spend hours analyzing market movement from historical and real-time data and then build mathematical models with timing, price, quantity, and other factors. These models would then monitor business news and trade activities in real-time to detect any changes in security prices.

As we saw from the pandemic, securities and stock prices have fluctuated from the lowest we have ever seen to the highest they've ever been. A year after Covid, stocks have gained 79 percent from the lows. From natural disasters and unplanned world events to tweets, anything can throw the stock market entirely off within a second. This is even more true as data becomes more accessible globally and platforms are created that generate more data.

To remain competitive, financial firms must be alert and prepared for changes in the market at any given moment. With digitization and globalization, it is becoming more apparent that advanced systems are necessary to predict stock movement accurately. Hedge funds have turned to AI to adapt to real-time market conditions and shortened trading windows through algorithmic trading.

Unlike human trading, which can involve emotion in the trading process, algorithmic trading, or algo trading, refers to algorithms to make better, more fact-based trade decisions. An algorithm is a set of defined rules that use computer programs to trade at high speeds and volume based on the preset rules. Unlike human trading, algo trading uses a more systematic approach based on facts like stock prices and specific market conditions instead of intuition or instinct. Mathematical models and formulas are used to execute high-speed, automated financial transactions.

For example, a trader can use algorithmic trading to executive orders quickly and automatically when a particular stock reaches or falls below a specific price. The algorithms can decide how many shares to buy or sell based on the set conditions. The trader can then focus on other tasks knowing that trades will automatically be executed when preset conditions are met.

3. Enhancing Personalization

Customers today demand brands to provide personalized experiences, and it's no different when it comes to financial services. Creating custom interactions not only builds loyalty but increases trust between a brand and consumer.

Banks, insurance firms, and asset management firms are turning to AI to create personalization within their products and services, which has only increased in 2021 and will continue to do so in 2022 and beyond. COVID-19 has accelerated the need for personalization as consumers trust brands less.

AI enables financial firms to navigate massive amounts of customer data and understand consumers' needs and desires. Whether in banking products like credit cards and loans, insurance policies, or portfolio management, bankers, insurers, and portfolio managers will need AI to gain insights into a customer's history, behavior, and interests so that professionals can anticipate their needs.

With AI, financial firms can segment customers into groups with similar interests, expectations, and needs, enabling professionals to identify different strategies for each group of customers, specific to their needs. The data and insights gained are valuable in determining where to spend the most resources and identifying the best opportunities, leading to more significant ROI and savings. Thanks to AI, the banking industry is projected to aggregate potential savings of $447 billion by 2023. Moving forward, AI will continue to help finance professionals forecast events and obtain valuable insights into their customers and competitors.

4. Informing Credit Decisions

Credit scores are essential to financial services. For example, retail and commercial banks use credit scoring to determine the level of risk involved in providing a credit card, mortgage, and loan. Retail and commercial banks can also extend or change loan terms based on an applicant's credit score. Additionally, insurance firms use credit scores when selling auto and home insurance policies.

Credit scores evaluate a customer's ability and willingness to pay off the debt by looking at various financial statements and documents. For fair and accurate credit decisions, a lot of data is needed, such as total income, credit history, current financial and tax records, work experience, payment history, and amount of existing debt, to name a few.

Most financial institutions rely on the credit scoring model, which uses mathematics, statistics, and accounting models on a large amount of data to analyze a potential borrower's past performance. With this method, a potential borrower can only be scored if they possess enough historical data on previous borrowing behavior. The disadvantage of this method is that without enough borrowing experience, even creditworthy borrowers can be rated as high-risk or even denied access to credit, which is typical for customers new to banking.

With 34 percent of consumers reporting a mistake on their credit report and 22 percent of U.S. consumers stating they had an application rejected, more innovative credit scoring solutions are necessary. Financial firms are looking to AI to make more accurate credit decisions and credit scoring. AI provides more sensitive, real-time indicators of a potential borrower's creditworthiness, such as their current income, employment opportunities, and earning potential. Therefore, borrowers with high potential can be included in credit services as well.

AI-based credit scoring allows accurate profit predictions based on intelligent AI models. As a result, with AI, credit scoring provides more sensitive, individualized credit score assessments based on various factual, real-time factors. More borrowers, including students, entrepreneurs, and foreign residents, can access credit while minimizing risk for lenders. AI can also help alert lenders for early warning indicators to credit risk so that banks and insurance firms are alerted before a consumer is at risk of defaulting.

Looking forward to 2022

Whether in accelerated trading, automating repetitive and manual processes, real-time credit decisions, or other financial services, AI is helping financial firms drive the future of finance for their customers and clients. Unfortunately, until now, larger financial firms like J.P. Morgan, Bank of America, UBS Financial Services, and Capital One, to name a few, have been the largest adopters of AI. For small and medium-sized enterprises, implementing AI can be a risk as it is expensive and time-consuming. Therefore, financial firms that are newer to AI's advantages are more hesitant to adopt new tools and strategies.

With the benefits that AI has brought to larger financial firms, innovations in the space have made AI more accessible for financial firms of all sizes. According to an Nvidia study, 83 percent of business decision-makers and technical implementers stated that AI is critical to their company's future success. Furthermore, over 34 percent of the survey respondents said that AI would increase the company's revenue by 20 percent.

It is increasingly more evident that AI is a necessity within the financial world. As digital platforms increase and expand the amount of global data available, firms that have access to the benefits of AI will thrive from both a revenue and reputation perspective, at the expense of those that don't. According to Mckinsey, financial companies that have implemented AI have attributed 20 percent of more in additional earnings. Additionally, a financial firm's bottom-line is 2.3x more likely to consider their C-suite leaders very effective if their organization uses AI.

In 2022, more financial services firms will look to the benefits that AI brings in data analysis, automation, and personalization. But one of the biggest challenges of deploying an AI solution is in demonstrating the credibility of AI. Since AI continues to evolve to meet financial services firms' needs, the accuracy of AI and NLP models will become better in detecting the sentiment and relevance of data sets and adapting to new rules set by the user.

As the world continues to change, the ability to quickly analyze various data sets at any given moment will be critical to a financial firm's success. For example, COVID-19 sparked a greater interest in environmental, social, and governance (ESG) investing. Firms that were able to use AI to quickly gather and analyze information were able to accurately identify companies that were acting in line with their ESG initiatives. With the popularity of ESG investments and ESG data and the challenges of spotting "greenwashing," AI will be critical in 2022 to evaluate a company's sustainability initiatives as more investors look to ESG investments.

Additionally, we can expect broader adoption of AI within financial services firms in 2022. Small and medium-sized banks and insurance firms will look to research and analyze large amounts of data, automate their manual screening processes, provide more personalized services, and inform credit decisions. Additionally, more hedge funds will look to AI to generate insights from data to predict stock market movement. As AI makes its mark across the entire industry, we can also expect that in 2022 AI will be more accessible.

More access to AI in 2022

Lastly, with technological innovations, more solutions to implement AI are being created to overcome the barriers to implementation. One of the biggest challenges many financial services firms face in implementing AI is the expertise required to deploy AI models. The rapid emergence of AI has created a massive increase in data science jobs, with the U.S. Bureau of Labor Statistics predicting that the data science field will grow about 28 percent through 2026.

Studies show that there are currently 151,000 unfilled data scientist roles. Skilled data scientists are needed to deploy AI models, but the problem lies in finding qualified data scientists capable of quickly building out accurate AI models.

In 2022, we can expect that AI will be more accessible to technical and non-technical users alike. As technology continues to advance, FinTech firms are emerging to provide solutions that require less technical expertise so a broader population can access AI. One of the ways in which AI is becoming more accessible is through a no-code platform.

No-code AI enables technical and non-technical users to deploy AI use cases without having to code. Since most financial services firms have specific AI use cases in mind, such as analyzing credit risk, evaluating ESG performance, automating screening processes, and pulling sentiment from data, to name a few, no-code AI provides financial services firms with an "out-of-box" solution so that users can deploy AI models specific to their needs and generate insights quickly.

As AI continues to transform the financial services industry and as we see the need for AI across small, medium, and large-sized enterprises, no-code AI will be the next big thing to look out for in 2022. Ultimately, financial firms will be able to use no-code AI to analyze thousands of applications and make decisions based on the insights gained. Banks, insurance firms, hedge funds, and other financial services firms will also reap the benefits of enterprise AI transformation without the technical requirements that often set financial services firms back. Ultimately, firms that implement no-code AI will remain competitive and gain the benefits of improved customer satisfaction, risk management, and ROI.

Are you interested in how AI can bring ROI to your organization? Learn how AI can enhance your financial service enterprise today by requesting a demo.

About Accern

Accern is a no-code AI platform that enables data scientists at financial organizations to easily build models that uncover actionable findings from structured and unstructured data. With Accern, you can automate processes, find additional value in your data, and inform better business decisions- faster and more accurately than before. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com